Levi Strauss (NYSE:LEVI) stock gained more than 8% in yesterday’s extended trading session following the release of better-than-expected Q1 results. Furthermore, the company raised earnings guidance for Fiscal 2024, buoyed by its cost control measures and restructuring efforts.

Levi is a global apparel company known for its iconic denim jeans and casual clothing.

LEVI’s Q1 Earnings Snapshot

The company posted adjusted earnings of $0.26 per share, which came above the analysts’ estimates of $0.21 per share. However, the reported figure declined by 23.5% from the prior-year quarter.

Meanwhile, Q1 revenues of $1.56 billion fell by 8% year-over-year but surpassed the Street’s estimates of $1.55 billion. The fall can be attributed to an 18% decrease in revenues from the Wholesale business, partially offset by a 7% rise in income from the Direct-to-Consumer (DTC) business.

Levi Provided Upbeat FY24 Outlook

The company has increased its adjusted EPS outlook for the full year 2024 to a range of $1.17 to $1.27 versus the prior range of $1.15 to $1.25. Analysts are expecting LEVI to report $1.22 per share. Additionally, Levi has reaffirmed its revenue growth guidance of 1% to 3% year-over-year.

It is worth noting that the company expects its cost-saving initiative, Project Fuel, and efforts to increase focus on DTC business to support its near-term performance.

Is LEVI Stock a Good Buy?

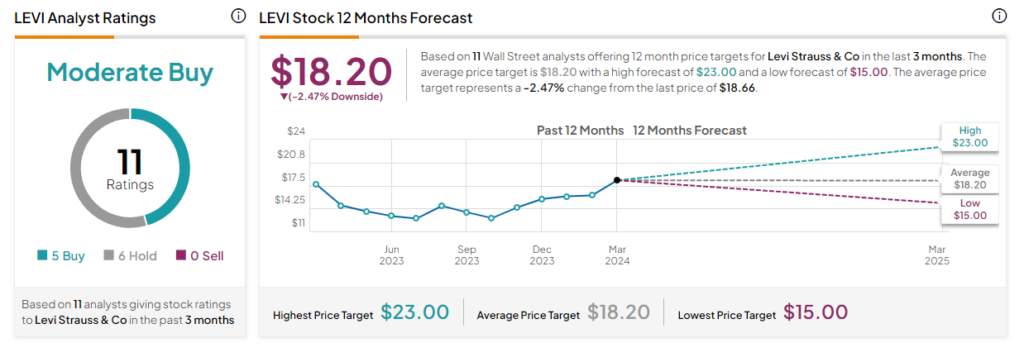

Following the release of the Q1 report, Guggenheim analyst Robert Drbul reiterated a Buy rating on LEVI stock and raised the price target to $23 (which implies 23.3% upside) from $20.

Overall, Wall Street is cautiously optimistic about Levi stock. It has a Moderate Buy consensus rating, based on five Buy and six Hold recommendations. After a surge of more than 41% in its stock price over the past six months, the analysts’ average price target of $18.20 implies a 2.5% downside potential from current levels.