The Defense Information Systems Agency (DISA) of the U.S. has awarded an $11.5 billion Defense Enclave Services (DES) contract to Leidos Holdings, Inc. (NYSE: LDOS). The indefinite-delivery, indefinite-quantity contract has a base period of four years. Thereafter, the contract can be extended thrice for a period of two years each.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Chairman and CEO of Leidos, Roger Krone, said, “We are honored that DISA has entrusted our team to establish the modern infrastructure foundation that will deliver critical combat support capabilities to our warfighters.”

Leidos Defense Group President, Gerry Fasano, said, “The Defense Enclave Services program demands unique expertise and advanced technology solutions. Leidos brings both at unparalleled scale, with a focus on constant innovation.”

The contract will bring the Defense Agencies and Field Activities (DAFA) on single network architecture and help provide services with improved security, enhanced user experience and network reliability.

About Leidos

Virginia-based Leidos is a defense, aviation, information technology, and biomedical research company that offers scientific, engineering, systems integration, and technical services to defense, intelligence, civil and health markets.

Following the announcement, after the markets closed on Monday, LDOS gained 3.6% to end the day at $105.50.

Wall Street’s Take

After the company released its fourth-quarter results last month, Goldman Sachs (NYSE: GS) analyst Gavin Parsons maintained a Buy rating on the stock and lowered the price target from $114 to $103 (1.1% upside potential).

In a research note to investors, Parsons said, “The company’s 2022 growth guidance is disappointing with COVID, funding delays and protested awards, all timing unknowns. Further, the company’s book to bill has slowed to 1.1 times, providing less support as Leidos navigates these headwinds.”

Additionally, Matthew Akers of Wells Fargo (NYSE: WFC) reiterated a Buy rating on Leidos and reduced the price target to $97 from $104 (4.8% downside potential).

Akers said that the guidance for 2022 missed his expectations, but “sales should benefit from SD&A business recovery, RHRP and Dynetics new program ramps in 2023 and beyond.”

Overall, the stock has a Strong Buy consensus rating based on seven unanimous Buys. The average LDOS price target of $103.29 implies 1.4% upside potential. Shares have gained 12.8% year-to-date.

Investors’ Opinion

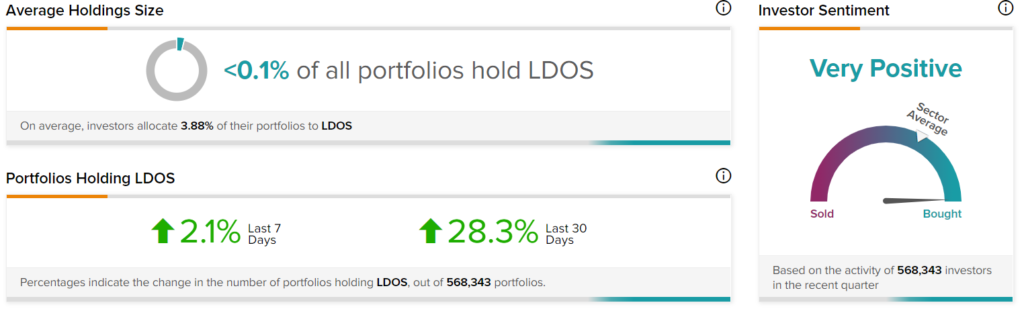

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Leidos, with 28.3% of investors on TipRanks increasing their exposure to the stock over the past 30 days.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Li Auto’s Li ONE Deliveries Skyrocket 266% in February

Healthcare Realty to Combine Business with HTA; Shares Fall 11%

3D Systems’ Q4 Results Beat Estimates; Shares Gain 11% Pre-Market