The troubles are mounting for Alphabet’s (NASDAQ:GOOGL) Google as legal punches keep coming. According to a Reuters report, publishers from 32 media groups collectively filed a €2.1 billion or $2.3 billion lawsuit against Google for its ad practices. Shares of the tech giant closed about 1.8% lower on Wednesday, February 28.

The consortium of publishers alleges that they incurred significant financial losses due to Google’s anti-competitive practices. They claim that, in addition to paying higher fees for ad tech services, Google’s monopolistic practices have hindered their ability to earn higher advertising revenues.

Google’s spokesperson refuted these allegations, dismissing the lawsuit as “speculative and opportunistic,” as the report highlighted. With this background, let’s delve deeper into GOOGL’s risk profile.

Google Risk Analysis

Google is entangled in numerous antitrust litigations, including advertising and search. Last year, a Danish Media Association, acting on behalf of Jobindex, an online job-search platform, filed a lawsuit against Google, asserting that the tech behemoth showed preferential treatment towards its own job search service, Google for Jobs.

Further, Google is embroiled in one of its biggest legal confrontations with the U.S. Department of Justice and a coalition of states. They accuse Google of employing restrictive agreements to stifle competition and maintain dominance in the search business.

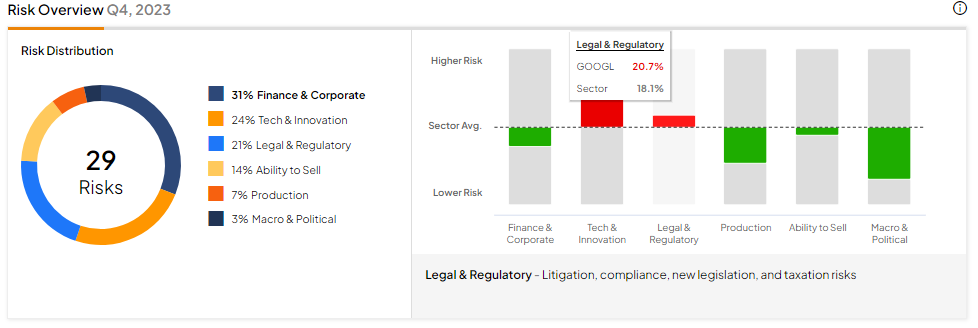

As GOOGL faces several litigations, its legal and regulatory exposure, as indicated by TipRanks’ Risk Analysis tool, is higher than the industry average. GOOGL’s legal and regulatory risks constitute 20.7% of its overall risk profile, exceeding the industry average of 18.1%. Further, its tech and innovation risk accounts for 24.1% of its total risk, significantly higher than the industry average of 15.5%. This is evident with its latest issues related to artificial intelligence (AI) tools.

Is Alphabet a Buy, Hold, or Sell?

Despite these legal challenges, Wall Street analysts maintain a bullish outlook on the stock. It has 29 Buys and eight Holds for a Strong Buy consensus rating. Further, GOOGL stock has gained about 51% in one year. Analysts’ average price target of $164.59 implies 20.68% upside potential from current levels.