Las Vegas Sands (LVS) is an American resort and casino operator with a global footprint. The company is in the process of selling its Las Vegas properties. (See Analysts’ Top Stocks on TipRanks)

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factor.

Q3 Financial Results

Las Vegas Sands reported revenue of $857 million for Q3 2021. That increased from $446 million in the same quarter last year but fell short of the consensus estimate of $1.24 billion. It posted an adjusted loss per share of $0.45, which narrowed from an adjusted loss per share of $0.59 in the same quarter last year but missed the consensus estimate for an adjusted loss of $0.20 per share.

Las Vegas Sands ended Q3 with $1.64 billion in cash and $3.93 billion in borrowing capacity. The company’s outstanding debt is $14.50 billion. (See Las Vegas Sands stock charts on TipRanks).

Corporate Updates

In September, Las Vegas Sands’ China unit offered senior unsecured notes maturing between 2027 and 2031 to raise $1.95 billion. The company intends to use the money to redeem certain outstanding notes.

Las Vegas Sands expects to close the sale of its Las Vegas properties in Q1 2022. The company agreed to sell the properties for $6.25 billion. CEO Robert Goldstein explained that the sale will enhance the company’s strategy of returning capital to shareholders and reinvesting in its Asian operations. The company has operations in China and Singapore.

Risk Factors

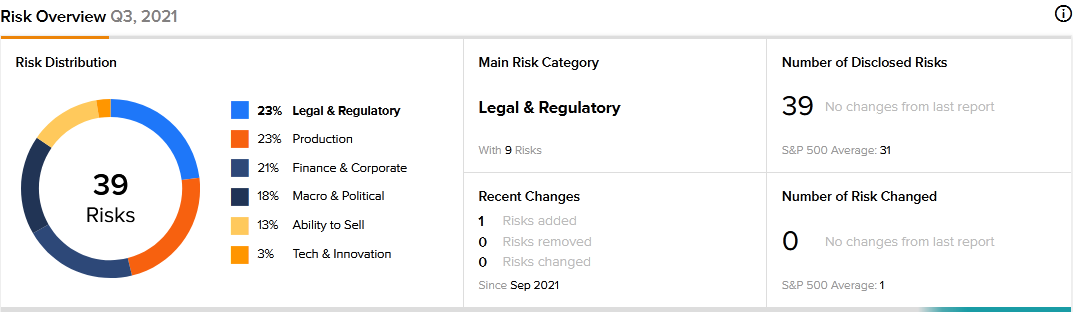

Las Vegas Sands carries 39 risk factors, according to the new TipRanks Risk Factors tool. Since Q4 2020, the company has updated its risk profile with one new risk factor under the Finance and Corporate category.

Las Vegas Sands tells investors that the decision to sell its Las Vegas properties presents many challenges. For example, the company says that some of its businesses will continue to operate under the brands being sold. It cautions that those businesses could suffer reputational damage if the associated brands fail to maintain their high standards and regulatory requirements. The company goes on to warn that the sale may make it difficult for it to retain and motivate key personnel during the transition period.

The majority of Las Vegas Sands’ risk factors fall under the Legal and Regulatory category, with 23% of the total risks. That matches the sector average. Las Vegas Sands’ stock price has declined about 36% year-to-date.

Analysts’ Take

Following Las Vegas Sands’ Q3 report, Stifel Nicolaus analyst Steven Wieczynski reiterated a Buy rating on the stock and raised the price target to $51 from $48. Wieczynski’s new price target suggests 34.25% upside potential. Noting that there is a perceived dislocation in the company’s share price, the analyst believes that the time is right for Las Vegas Sands to get aggressive with stock buybacks.

Consensus among analysts is a Moderate Buy based on 4 Buys and 6 Holds. The average Las Vegas Sands price target of $49.75 implies 30.96% upside potential to current levels.

Related News:

Autoliv Reports Disappointing Q3 Results

Taking Stock of Whirlpool Corp’s Risk Factors

Understanding Danaher’s Newly Added Risk Factor