Autoliv, Inc. (ALV) reported disappointing third-quarter results due to lower net sales, higher raw materials costs, and higher customer call-offs.

Autoliv engages in the development, manufacture, and supply of automotive safety systems to leading car manufacturers worldwide. With a market cap of $8.07 billion, shares have gained 11.4% over the past year. (See Insiders’ Hot Stocks on TipRanks)

The company reported adjusted earnings of $0.73 per share, down 50.7% year-over-year and $0.11 lower than analyst estimates of $0.84 per share.

Moreover, net sales declined 9.3% year-over-year to $1.85 billion and also failed to meet consensus estimates of $1.92 billion. Autoliv’s Airbag Products segment decreased 9.9%, while Seatbelt Products declined 8.3% year-over-year. Sales fell due to ongoing semiconductor shortages and other supply chain issues, which resulted in lower light vehicle production (LVP) volume worldwide.

On a positive note, Autoliv noted that its supply to the electric vehicles (EV) market grew remarkably with new product launches in this category. The company expects a doubling of sales to this market in 2021.

Commenting on the results, Mikael Bratt, President & CEO of Autoliv, said, “Through successful mitigation efforts, the raw materials headwind in the third quarter was slightly lower than expected. However, we see new raw material headwinds, including higher magnesium and resin costs… We expect supply disruptions to continue to impact LVP negatively in the fourth quarter, and although there are some indications of moderate improvement in semiconductor availability in Asia and North America, visibility remains poor.”

Despite undertaking stricter measures to mitigate current business challenges, ALV reduced its full-year Fiscal 2021 outlook for net sales growth to 11%, and organic sales growth to 8%.

In response to Autoliv’s disappointing performance, Mizuho Securities analyst Vijay Rakesh lowered the price target on the stock to $106 (16.9% upside potential) from $109 while maintaining a Buy rating.

Rakesh said, “Despite near-term industry headwinds, we continue to see ALV well-positioned with its leading ~45% global automotive market share in passive safety airbags/seat belts and LVP outperformance with content growth tailwinds in EV.”

The analyst is also encouraged by ALV’s solid order book, growing share, and increasing content in key launches.

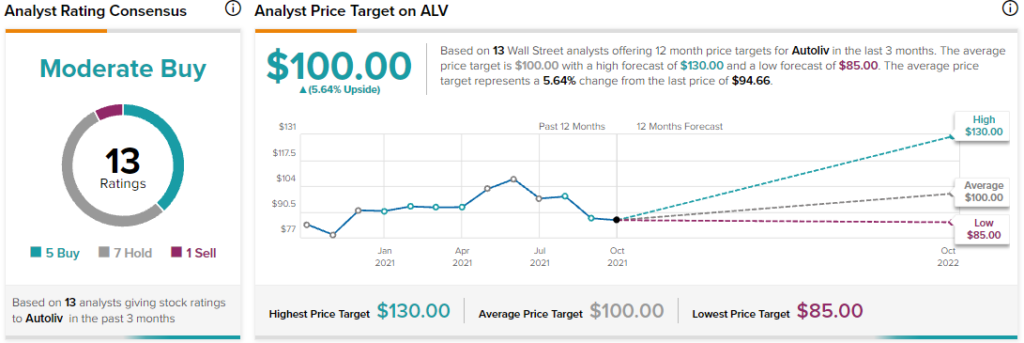

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys, 7 Holds, and 1 Sell. The average Autoliv price target of $100.00 implies 5.6% upside potential to current levels.

Related News:

Snap Plunges 22% After-Hours on Disappointing Q3 Results

Intel Delivers Mixed Q3 Results & Guidance; Shares Fall 9% After-Hours

Boston Beer Delivers Mixed Q3 Results; Shares Slip 3.3% After-Hours