Lantheus Holdings (NASDAQ: LNTH) shares jumped 12.3% on April 29 to close near the stock’s 52-week high at $66.41. This movement came after the company delivered blowout first-quarter results, and also raised its FY2022 guidance well above the analyst expectations.

Markedly, shares of the global leader in the development, distribution and commercialization of innovative diagnostic image agents and products and artificial intelligence solutions, have gained over 180% in the past year.

Q1 Beat

The company reported stellar quarterly earnings of $0.97 per share, significantly higher than analysts’ estimates of $0.46 per share and much higher than earnings of $0.05 per share reported in the prior-year period.

To add to that, revenue climbed a whopping 125.8% to $209 million compared to the prior-year period and outpaced the Street’s estimate of $165.29 million.

Raised FY2022 Outlook

Based on robust Q1 results, management raised the financial guidance for FY2022.

The company now forecasts adjusted earnings in the range of $2.90 to $3.15 per share, much higher than the previous range of $1.95 to $2.05. The consensus estimate is pegged at $2.05 per share.

Furthermore, FY2022 revenues are forecast to be in the range of $800 – $835 million, superior to the range of $685 million to $710 million guided earlier and far ahead of the consensus estimate of $711 billion.

For the fiscal second quarter, adjusted earnings are likely to range between $0.67 and $0.73 per share, while the consensus estimate is pegged at $0.50 per share. Revenues are projected to be in the range of $200 to $215 million, versus the consensus estimate of $179 million.

CEO’s Comments

Lantheus Holdings CEO Mary Anne Heino commented, “We are excited by our recent strategic collaborations for PYLARIFY and PYLARIFY AI and continue to assess longer-term revenue opportunities through strategic transactions and internal development to drive shareholder value.”

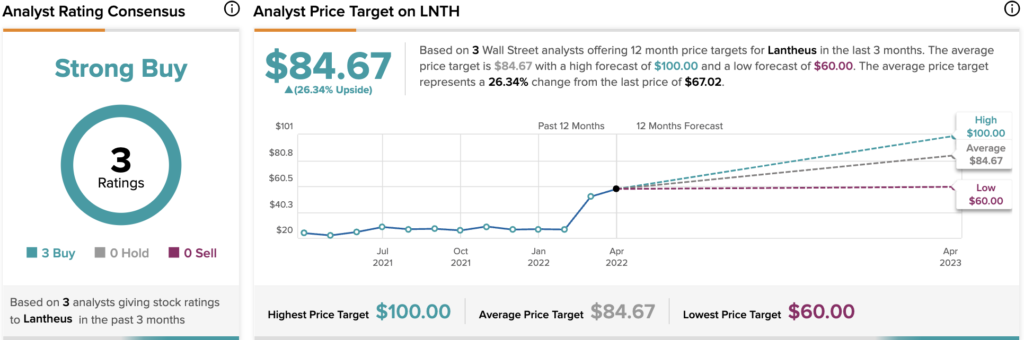

Wall Street’s Take

Consensus among analysts currently results in a Strong Buy based on three unanimous Buys. The average Lantheus stock forecast of $84.67 implies 26.34% upside potential to level seen at 9:50 am EST on Monday.

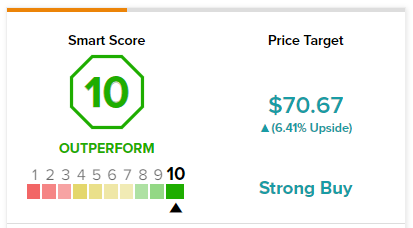

TipRanks’ Smart Score

LNTH scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Key Takeaway

The quarterly beat was driven by amplifying sales of the company’s leading prostate cancer imaging agent PYLARIFY.

Notably, the company has a solid pipeline of products that are in late-stage trials. Right execution across its diversified products portfolio could lead to robust growth and profitability for the stock in the long run.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

ServiceNow Shares Up 8% on Q1 Beat

Twitter Posts Mixed Results For Q1

Roku Shares Gain 3% Despite Mixed Q1 Results & Muted Outlook