The broader market indices continued the upward trend in December 2023, ending the year on a higher note. Simultaneously, most of the magnificent seven stocks sustained their upward trajectory, maintaining the positive momentum in their prices that commenced earlier in the year.

Meta Platforms (NASDAQ:META) gained the most among the magnificent seven stocks, rising about 8.2% in December 2023. At the same time, Nvidia (NASDAQ:NVDA) stock gained about 6%. On the other hand, Microsoft (NASDAQ:MSFT) stock, which recorded stellar growth in 2023 due to its Artificial Intelligence (AI) initiatives, dropped marginally in December.

Returning to the three major U.S. indices, the S&P 500 (SPX) gained about 4.4%. Meanwhile, the Nasdaq 100 Index (NDX) and the Dow Jones Industrial Average (DJIA) increased approximately 5.5% and 4.8%, respectively.

In this context, we looked into the Buy and Sell transactions carried out by investors maintaining a TipRanks Smart Portfolio, seeking a more profound insight into the trading patterns throughout December.

December’s Most-Bought Stock

Technology giant Microsoft was the most-bought stock for December. The investor’s confidence in MSFT stems from its AI initiatives. Microsoft is rapidly incorporating AI across its products, which is positively impacting its financial and operating performance and, in turn, its share price.

Further, its new product launches, the ongoing shift towards the cloud, and the expected increase in technology spending in 2024 augur well for growth.

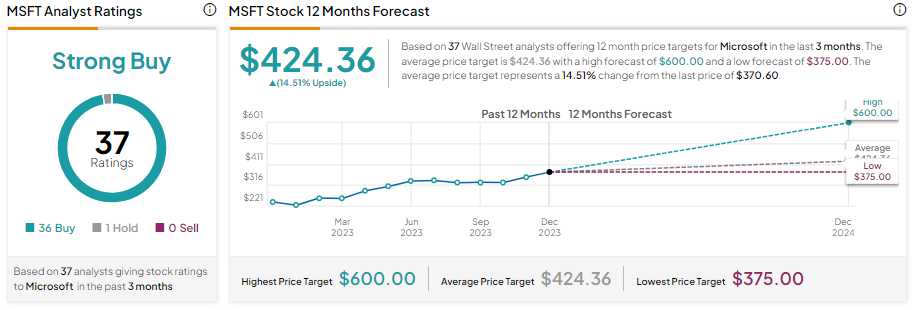

Is MSFT a Buy, Sell, or Hold?

With 36 Buys and one Hold recommendation, Microsoft stock has a Strong Buy consensus rating. Further, analysts’ average price target of $424.36 implies 14.51% upside potential from current levels.

Along with Microsoft, let’s look at the other most-bought stocks for December.

Top 10 Most-Bought Stocks

Observing the investment trends in December, we discovered investors continued to trade primarily in tech stocks, as nine of the top 10 most-bought stocks belonged to this sector. Here is the list of the most-bought stocks for December:

- Microsoft

- Nvidia

- Apple (NASDAQ:AAPL)

- Amazon (NASDAQ:AMZN)

- Tesla (NASDAQ:TSLA)

- Alphabet Class A (NASDAQ:GOOGL)

- Alibaba (NYSE:BABA)

- Meta

- Pfizer (NYSE:PFE)

- Advanced Micro Devices (NASDAQ:AMD)

December’s Most-Sold Stock

Surprisingly, Apple, which consistently remained the most bought stock in 2023, was most sold by investors maintaining a TipRanks Smart Portfolio. Concerns around the innovation front and hardware sales are keeping analysts cautiously optimistic about its prospects.

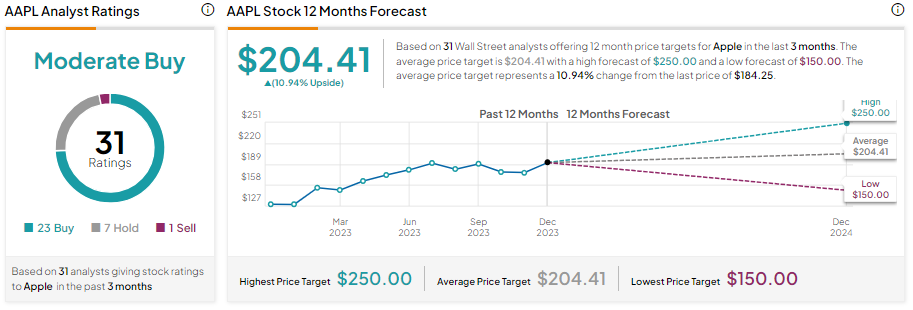

Is Apple Stock Expected to Rise?

Apple stock has a Moderate Buy consensus rating, reflecting 23 Buys, seven Holds, and one Sell recommendation. Further, analysts’ average price target of $204.41 shows a limited 10.94% upside potential from current levels.

While Apple was the most sold stock, let’s look at the complete list for December.

- Apple

- Amazon

- Tesla

- Microsoft

- Nvidia

- Alibaba

- Alphabet Class A

- Meta

- AMD

- Palantir Technologies (NYSE:PLTR)

We’ll be back soon with the top-traded stocks from January 2024. In the meantime, stay informed about the market trends by effortlessly tracking your portfolio’s performance with the TipRanks Smart Portfolio tool.