With so many investing groups and forums online, it can be easy to be swept up in hype and FOMO (fear of missing out) and make bad investments based on the latest trends. However, that doesn’t mean you can’t find online investment advice worth following. There are genuine experts out there who can help you improve your returns. So, who are they and can you find and follow them?

City analysts

Banks and investment firms employ analysts to examine the prospects of publicly traded companies. Analysts often focus on one sector, making them experts in that field, and produce detailed reports about the firms that they cover. Both institutional and individual investors include such reports when conducting research about which shares to invest in.

In their reports, analysts present evidence for how they rate shares in the company they are researching. Ratings will be a recommendation to buy, hold or sell shares, based on their findings. Analysts also set 12-month price targets, giving investors an idea of how much profit they could potentially make over the next year.

While following the advice of professional analysts may seem like a sound strategy, it isn’t quite so simple. Sometimes banks and investment firms have a financial interest in the companies that their analysts cover. This conflict of interest means that investors do need to exercise some caution when following an analyst’s rating.

As with any profession, not all analysts consistently perform well. You can use TipRanks to find out how good an analyst really is. Just search for their name on the search bar on the platform. In addition, TipRanks ranks analysts based on their performance track records and even presents their performance on a per-share basis.

Take Portia Patel from Canaccord Genuity. Patel covers the finance sector and was the top performing analyst in the UK in 2021. If in 2019, you started to invest each time that Patel made a buy rating and you held that investment for one year, 70% of your transactions would have made a profit. Your average return would be almost 20% per transaction.

If you want to be notified whenever Patel makes a rating, then all you need to do is to hit the blue follow button.

You don’t need to know the names of analysts to find and follow them. See who the top-performing analysts in the UK are and start following them today.

Financial bloggers

Bloggers may not carry the same clout as analysts; however, they also don’t have the same conflicts of interest. This means that their independent research can be a powerful source of information for investors. In addition, their share recommendations are publicly available, unlike most analysts’ reports.

However, not all bloggers get it right and while in the UK the Financial Services Authority (FSA) can investigate analysts, there is no such body holding financial bloggers accountable for their recommendations.

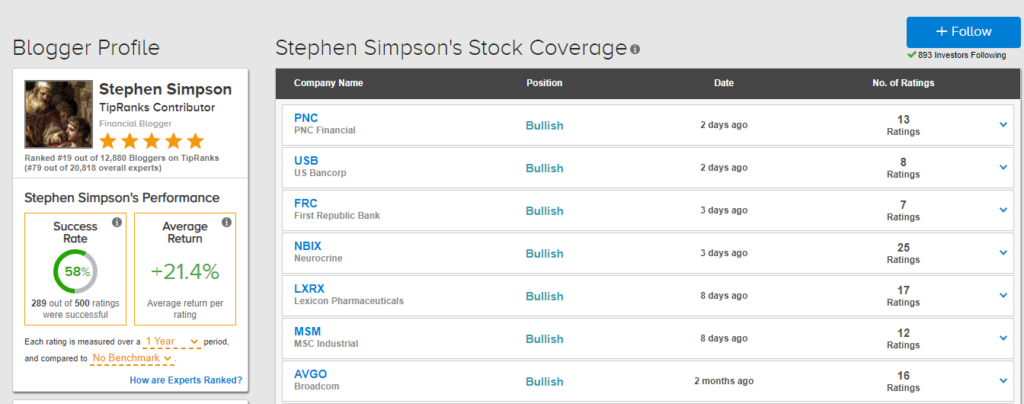

Again, TipRanks lets you track how bloggers perform over time. It tracks the world’s leading financial blogs and analyses their writers’ recommendations. As with analysts, you can check how well a blogger ranks and investigate how well they have performed on each of the stocks they write about.

Let’s look at one of TipRanks’ contributors, Stephen Simpson. 289 out of 500 recommendations he made have resulted in a profit, with an average return of over 21%. Again, you can follow the bloggers of your choice, just press the blue button.

Once more, you don’t need to know the names of the top financial bloggers covering the UK markets, you can find them all here.

Company directors

You’ve likely heard the phrase ‘insider trading’ – but it’s not always murky, or illegal. Corporate insiders such as company directors can trade in their own companies, with conditions. To trade legally in the UK, directors are required to report their transactions to the Financial Conduct Authority.

A director buying shares in their own company with their own cash is an important indicator to investors. Often within days of an insider buying shares in their company, the share price rises.

While following directors can be a profitable strategy, it is also difficult to execute. A director’s compensation generally includes stock options, giving them the right to buy shares at a set price before a certain date. If an executive exercises an expiring option, their transaction doesn’t indicate sentiment.

TipRanks provides a solution by scanning directors’ reports and differentiating between trades that indicate insider sentiment, ‘informative transactions’, from those that don’t, ‘uninformative transactions’ as well as ranking directors according to their performance history. And directors often have outsized returns.

Werner Lanthaler is CEO of therapeutics company Evotec. Since 2009 he has made 31 informative buy trades in the company, 25 of which have resulted in profit. Particularly notable is his average return per transaction which sits at over 100% per transaction. Now think about how powerful this information is and how it can benefit your investment strategy by simply being notified whenever he reports a trade.

You can find and follow the top directors in the UK here.

Build a virtual team of experts

In the financial world, there is a lot of hype, opinion, and noise about market opportunities. However, much of it comes without any transparency or accountability. This is where TipRanks comes in.

If you want to find out who the top financial experts in the UK are and be notified whenever they recommend or buy shares, just head over to the TipRanks Expert Centre to discover who is making the best transactions and follow the experts of your choice.

Twitter | Instagram | Facebook | TikTok | LinkedIn | Support