All in all, investors faced challenges in 2022, including inflation and interest rate hikes. As we enter 2023, it is important to know that the macro-economic environment is not going to change overnight. According to a research report by Goldman Sachs (NYSE:GS), the bear run in the markets will continue and could hit a peak before some level of correction starts, by the end of 2023.

As an investor, it is important to be well-armed and prepared. Rather than focusing on short-term goals, one’s portfolio should reflect the bigger picture.

Here are a few strategies that can help build the best portfolio for 2023.

Geographic Diversification

Diversification is considered one of the most important rules in building a safe portfolio. Diversifying the portfolio among risky, balanced, dividend, growth, and stable stocks has always helped investors mitigate risk. While building a balanced portfolio, investors should not be confined to specific geographies.

In 2023, crossing the border to select the right stocks will be a good choice. Different countries are at different growth stages, which impacts the returns of their companies’ stocks, so holding stocks on various exchanges can help protect against market volatility.

TipRanks’ database offers insights into markets such as the U.S., UK, Germany, Singapore, Canada, Spain, Australia, and Germany. The Trending Stocks tool is the best way to get an idea about the stocks in different markets that are on the radar of analysts.

Apart from this, diversifying the portfolio among different sectors and industries can compensate for the downfall of any underperforming stocks. Sectors such as energy, utilities, consumer staples, healthcare, etc. perform comparatively better during recessionary times.

Dividend-Paying Stocks

Heading into 2023, analysts are highly bullish on dividend stocks. The steady income in the form of dividends keeps investors’ hope alive in the market. Such stocks play an important role during times of volatility.

According to TipRanks, some of the stocks with high dividend yields are AT&T (NYSE:T) at 7.3%, Altria Group (NYSE:MO) at 7.9%, Imperial Brands (GB:IMB) at 6.7%, Allianz (DE:ALV) at 5.3%, and more. The Highest Dividend Stocks tool on TipRanks provides a complete list of companies with high dividend payments that can be compared with each other on different parameters. Investing in these stocks will help investors offset the pressure of high inflation and shaky share price movements.

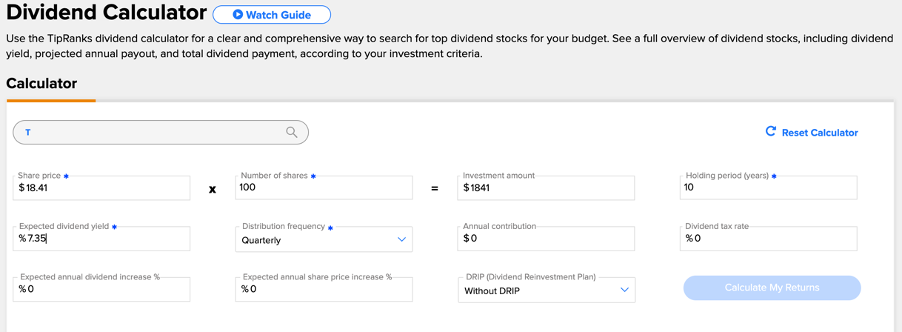

TipRanks also provides a Dividend Calculator tool, which lets you get a real picture of your dividend payments, customized to your requirements.

Combining Value and Growth Stocks

As Warren Buffet rightly said, “Growth and value investing are joined at the hip.”

A correct mix of growth and value stocks gives an investor a buffer to play against any economic cycle. Due to their difference in risk appetite, dividend payments, and time frame, both of these approaches balance out the overall returns.

Value stocks perform better during the recessionary time frame, and analysts believe the trend will continue in the first half of 2023. However, by the end of 2023, returns could start favoring growth companies again.

Index Investing

The main aim of an index fund is to copy the returns of any major stock exchange like the FTSE 100, the Nasdaq Composite, etc. Investment in index funds will likely be a safe choice for investors in 2023. Firstly, these funds offer a great deal of diversification, which is the need of the hour. With the funds, the investor gains exposure to hundreds of stocks, which spreads the risk. Secondly, index funds save a lot of time and effort on the part of investors, with their ease of management.

A combination of index funds and single stocks can go a long way for investors.

Final Thoughts

The year 2022 has made investors more defensive but also well-prepared for what lies ahead. From pandemic to war to high inflation, the year has given us a lot to worry about. However, these times will come and go in the stock market; all we need to do is be cautious and have a long-term perspective.

As macro-economic conditions change, it is important to make changes in one’s portfolio strategy accordingly. Following the above-recommended strategies, and using TipRanks to drive your stock research, can go a long way toward bolstering your portfolio in 2023.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue