American fashion retailer L Brands (LB) plans to split into two publicly traded companies in a restructuring it hopes will enhance long-term value for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The split will result in Victoria’s Secret, a lingerie and beauty retailer, and Bath & Body Works, a specialty fragrance retailer, becoming independent publicly traded companies. L Brands plans to process the Victoria’s Secret spin-off in a manner that will avoid tax consequences for its shareholders.

The company believes the separation will allow the units to thrive in a retail environment that is evolving. L Brands’ board chair Sarah Nash said the company has spent the last 10 months improving merchandise and marketing, as well as controlling costs, in order to increase profitability. Consequently, Victoria’s Secret has become well-grounded enough to run as a standalone company.

“The Board believes that this path forward will return the highest value to shareholders and that the separation will allow each business to achieve its best opportunities for growth,” said Nash.

L Brands had considered selling before it chose to spin off the lingerie brand. It expects to complete the transaction in August 2021. Alongside the split announcement, L Brands said it expects to report strong first-quarter earnings. (See L Brands stock analysis on TipRanks)

Wells Fargo analyst Ike Boruchow reiterated a Buy rating and raised the price target to $84 from $78. Boruchow’s new price target implies 24.32% upside potential to the current price.

The analyst likes L Brands’ optimistic earnings forecast and the planned tax-free Victoria’s Secret spin-off. “For the third time this quarter, L Brands raised its earnings outlook,” commented Boruchow.

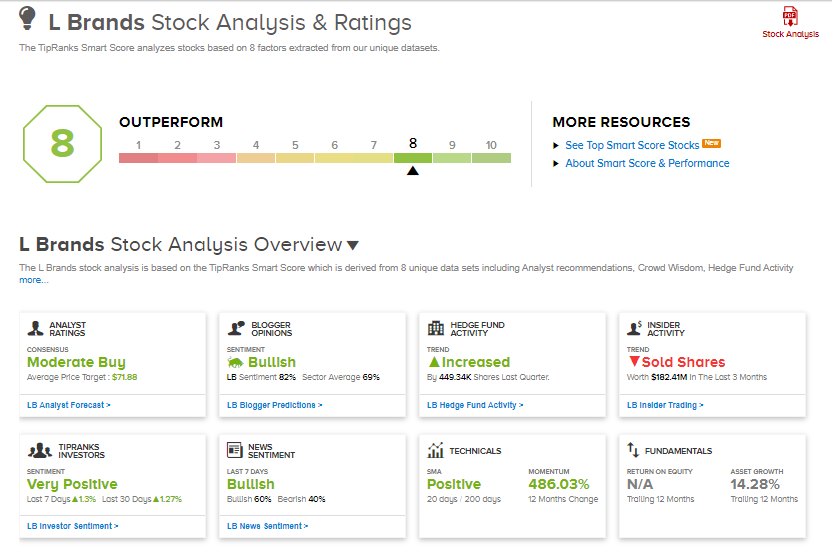

Consensus among analysts on Wall Street is that LB is a Moderate Buy, based on 10 Buy and 7 Hold ratings. The average analyst price target of $71.88 implies 6.38% upside potential to current levels.

LB scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating the stock is likely to outperform the market.

Related News:

Facebook Facing Fine Over Unconsented Israeli Acquisitions?

Amazon Expanding In Louisiana With Robotics Fulfillment Center

AbbVie Unit To Acquire Soliton For $550M To Boost Aesthetics Unit