The secretaries of state from Colorado, Arizona, Maine, Minnesota, New Mexico, Rhode Island, and Vermont have urged the U.S. Federal Trade Commission (FTC) to block grocery chain Kroger’s (NYSE:KR) proposed $24.6 billion acquisition of rival grocer Albertsons, citing concerns over the impact on competition.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Seven U.S. States Oppose Kroger-Albertsons Deal

In a letter to FTC Chair Lina Khan, the secretaries of state from the seven aforementioned states, representing 4,996 potentially affected stores, contended that the deal would give the combined entity control of nearly 25% of the entire U.S. food retail market and cause significant consolidation in a market which is already seeing limited competition.

Further, the secretaries of state pointed out that Kroger’s projection that the merger would generate household savings of $5.88 per year does not account for inflation. They also highlighted the merger’s implications for local suppliers, farmers, and small businesses that depend on a competitive grocery market. The officials believe that the merger would give Kroger-Albertsons massive power to dictate prices that would harm farmers and shippers.

Overall, the secretaries of state expressed their strong opposition to the merger, as it will further strain American families that are already struggling due to high inflation.

As per Reuters, a Kroger spokesperson said that the planned deal would benefit consumers and store workers. The spokesperson said that non-unionized rivals like Walmart (NYSE:WMT) and Amazon (NASDAQ:AMZN) would stand to benefit if the deal is blocked.

Kroger’s proposed acquisition of Albertsons, announced in October 2022, is facing a federal antitrust probe by the FTC. Reportedly, the agency has reached out to experts in farming and smaller grocery chains to assess the impact of the deal.

Is Kroger Stock a Buy or Sell?

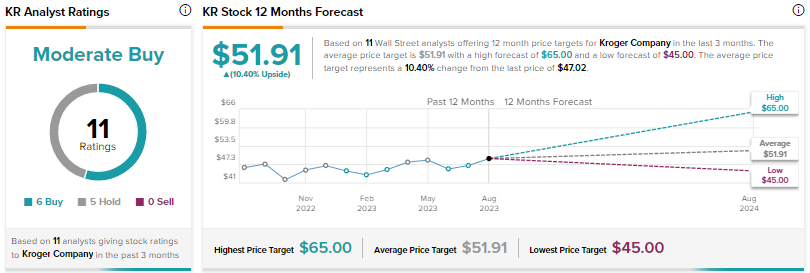

Wall Street is cautiously optimistic on Kroger stock, with a Moderate Buy consensus rating based on six Buys and five Holds. The average price target of $51.91 implies 10.4% upside. Shares have risen 5.5% year-to-date.

Investors should note that Argus Research analyst Chris Graja is the most accurate analyst for KR stock, according to TipRanks. Copying his trades on KR and holding each position for one year could result in 73% of your transactions generating a profit, with an average return of about 17% per trade.