The Kroger Co., one of the world’s largest retailers, posted better-than-expected fiscal 4Q earnings, driven by strong online sales. Meanwhile, total sales for the quarter fell short of analysts’ expectations. Shares closed 2.5% higher on Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Kroger (KR) reported 4Q adjusted earnings of $0.81 per share, up 42.1% year-over-year, and beating analysts’ expectations of $0.69. Total adjusted sales of $30.7 billion missed the Street’s estimates of $30.86 billion but advanced 10.7% from the year-ago period.

The company’s identical sales without fuel grew 10.6% in the quarter, while digital sales surged 118%. Adjusted operating profit came in at $837 million, up 10.4% year-over-year. (See Kroger stock analysis on TipRanks)

For fiscal 2021, the company projects adjusted EPS to be in the range of $2.75-$2.95, versus the consensus estimate of $2.69. Identical sales without fuel are expected to decline 3%-5%. Adjusted operating profit is forecasted to generate between $3.3 billion to $3.5 billion.

Kroger’s CFO Gary Millerchip said, “We expect our two-year identical sales stack to be in the range of 9% to 11%. In addition, we expect our adjusted net earnings per diluted share and adjusted FIFO operating profit to have compounded annual growth rates of between 12% and 16% and 5.4% and 8.5%, respectively. Over the two years, this would result in total shareholder return significantly above our previously communicated target of 8-11%.”

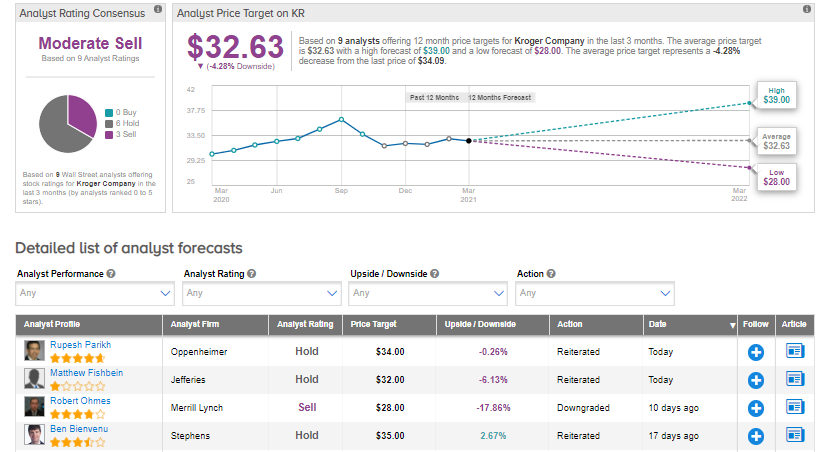

Following fiscal 4Q results, Oppenheimer analyst Rupesh Parikh maintained a Hold rating and a price target of $34 on the stock. The analyst believes “the report should be enough to support shares at current levels in quite a challenging setup for grocers given pending difficult comparisons.”

The rest of the Street is cautiously bearish about the stock with a Moderate Sell consensus rating. That’s based on 6 Holds and 3 Sells. The average analyst price target of $32.63 implies 4.3% downside potential to current levels. Shares have increased around 2% over the past year.

Related News:

Nektar Posts Better-Than-Feared Quarterly Loss, Misses On Revenues

Domino’s 4Q Results Miss Analysts’ Expectations; Shares Tank 7%

Sage Posts Surprise Quarterly Profit As Sales Surge; Shares Pop 6%