Klarna (KLAR) stock is climbing in pre-market trading as Wall Street analysts issue a wave of Buy ratings following its blockbuster U.S. listing on September 10, 2025. The Swedish fintech giant is one of Europe’s largest buy now, pay later (BNPL) players, and the U.S. has become its second-largest market. Despite the positive momentum, KLAR is currently trading nearly 29% below its IPO (initial public offering) high of $57.20.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company recently received consecutive “Buy” ratings, signaling growing confidence in its outlook. Klarna’s popular “pay-in-4” plan lets customers split their purchases into four equal, interest-free payments over six weeks. It also offers longer-term BNPL plans with interest. The company has also expanded into credit and debit cards and now holds a banking license in Europe.

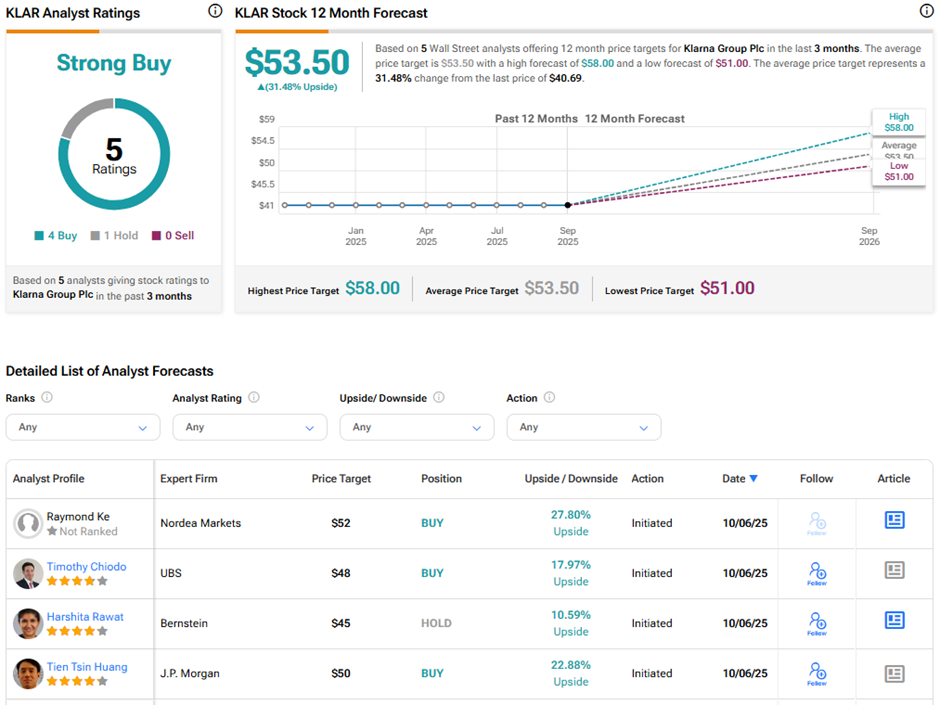

Analysts Lead Klarna with Buy Ratings

KBW analyst Sanjay Sakhrani initiated coverage of Klarna with a $52 price target, which implies 27.8% upside potential from current levels. He highlighted Klarna’s position as the most globally diversified provider in the BNPL segment, operating across 26 countries. Sakhrani noted that Klarna’s expansive merchant network drives strong network effects, with each new user or merchant increasing value for all participants.

Simultaneously, Citi assigned a Street-high price target of $58, implying 42.5% upside potential. Citi expects Klarna’s key performance indicators (KPIs) to grow due to its presence in the fast-growing and largely untapped BNPL market. The firm anticipates that Klarna’s transaction margins will improve in fiscal year 2026 and holds a positive outlook on the stock. This optimism is supported by the rapid expansion of the BNPL market, driven by increased e-commerce adoption and consumer demand for flexible payment options.

At the same time, Goldman Sachs initiated coverage with a $55 price target, implying 35% upside potential. The firm highlighted that Klarna is the market leader in BNPL services, especially in Europe. The company has created a new type of closed-loop payment system, similar to American Express (AXP) in the U.S., and GS expects Klarna to continue gaining market share over time as it expands its reach.

Meanwhile, J.P. Morgan analyst Tien Tsin Huang assigned a $50 price target, implying 22.9% upside. He described Klarna as a “fintech pioneer that has grown into an international financing and commerce powerhouse.” Huang noted that Klarna is growing in the U.S. and offering more profitable long-term loans, and noted that the stock is priced lower than its main competitor, Affirm (AFRM).

Is Klarna a Good Stock to Buy?

On TipRanks, KLAR stock commands a Strong Buy consensus rating based on four Buys and one Hold rating. The average Klarna price target of $53.50 implies 31.5% upside potential from current levels.