Keysight Technologies, Inc. (KEYS) on Thursday announced that it has acquired software test automation provider Eggplant from private equity firm Carlyle Group, in a deal valued at $330 million.

The combination of software testing company Keysight and Eggplant brings together two complementary companies in the automated software testing market at a time when more than ever, businesses need to accelerate their digital transformation to remain competitive. Meanwhile, the ever-growing scale and breadth of testing required for digital products is increasing complexity.

Eggplant, which last year generated $38 million in revenues, uses artificial intelligence (AI) and analytics to automate test creation and execution. Its digital automation intelligence platform can test any technology on any device, operating system or browser at any layer, from the user interface (UI) to application programming interfaces (APIs) to the database.

“As a recognized leader and trusted advisor in layer 1-7 design and test, Keysight is excited to add Eggplant’s test capabilities for the software application layer, aligning with our strategy to grow our first-to-market software-centric solutions,” said Keysight chairman and CEO Ron Nersesian. “We’re thrilled to welcome the Eggplant team to the Keysight family and look forward to working together in the fast-growing intelligent software test market with differentiated software-as-a-service technologies.”

Shares in Keysight dropped 2% to $99.19 in afternoon trading. The stock has been on a recovery path since reaching a low in March and is now priced close to its start of the year level.

Citigroup analyst Jim Suva maintains a Buy rating on the stock, saying that the company’s fundamentals are improving.

“The stock will be under pressure near term buy it will be short-lived as production is ramping up,” Suva said in a note to investors.

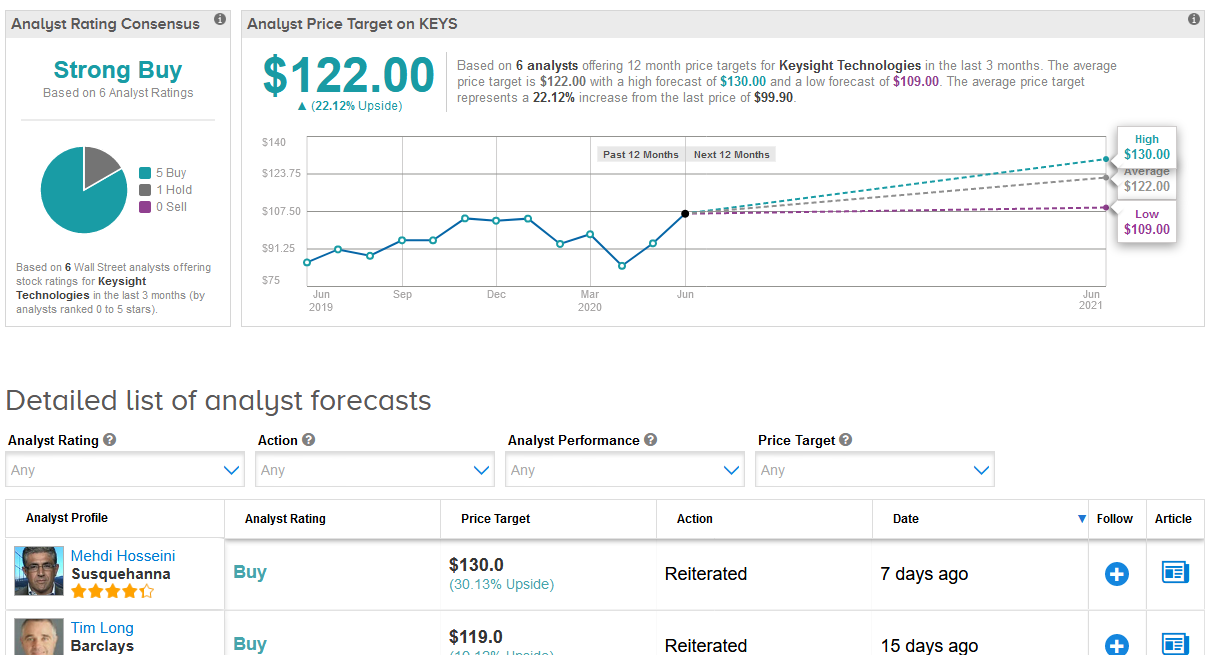

In line with Suva, the Street is bullish on the company’s outlook. The stock scores 5 Buy ratings versus 1 Hold rating from analysts adding up to a Strong Buy consensus. The $122 average price target implies 22% upside potential in the shares over the coming year. (See Keysight stock analysis on TipRanks)

Related News:

Apple Buys Device Management Startup Fleetsmith

Slack Seeks To Replace E-mail With Launch Of Virtual Business Platform

Microsoft’s Xbox Closes Mixer Live Streaming, Partners With Facebook Gaming