SoundHound AI (NASDAQ:SOUN) has so far been one of the year’s star performers. Boosted by an investment from AI behemoth Nvidia and riding the AI-themed trend, investors have sent shares up by 166% year-to-date.

The gains would have probably been even more impressive had the company delivered a better Q4 report. The shares have retreated by 24% since the quarterly earnings report hit last week, after the results showed that revenue fell below the midpoint of the guidance and the company reported a bigger-than-anticipated adj. EBITDA loss.

However, as H.C. Wainwright analyst Scott Buck points out, the Q4 readout featured positives too.

“While 4Q23 results likely warranted some pullback in SOUN shares, 2024 and 2025 guidance should drive renewed investor optimism and support much of the recent appreciation in SOUN shares,” the analyst opined.

At the midpoint, the voice recognition specialist sees more than 50% revenue growth in 2024 and further acceleration in 2025. Moreover, consistent with Buck’s previous view, in 2025, the company expects to reach full-year positive adj. EBITDA. The revenue growth is getting a boost from a cumulative subscriptions & bookings backlog of $661.0 million, which more than doubled compared to the previous year. Furthermore, the recent acquisition of SYNQ3 should result in “meaningful revenue synergies,” as the company cross-sells AI services into SYNQ3’s existing restaurant customers. “While the pursuit of these revenue opportunities may delay profitability from 2024 to 2025, we suspect the longer-term financial and operating benefits to meaningfully outweigh short-term profitability headwinds,” Buck elaborated.”

As such, in anticipation of stronger operating results, Buck recommends investors “continue to accumulate” SOUN shares. “Valuation remains attractive given meaningful growth opportunity and investor demand for AI,” he summed up.

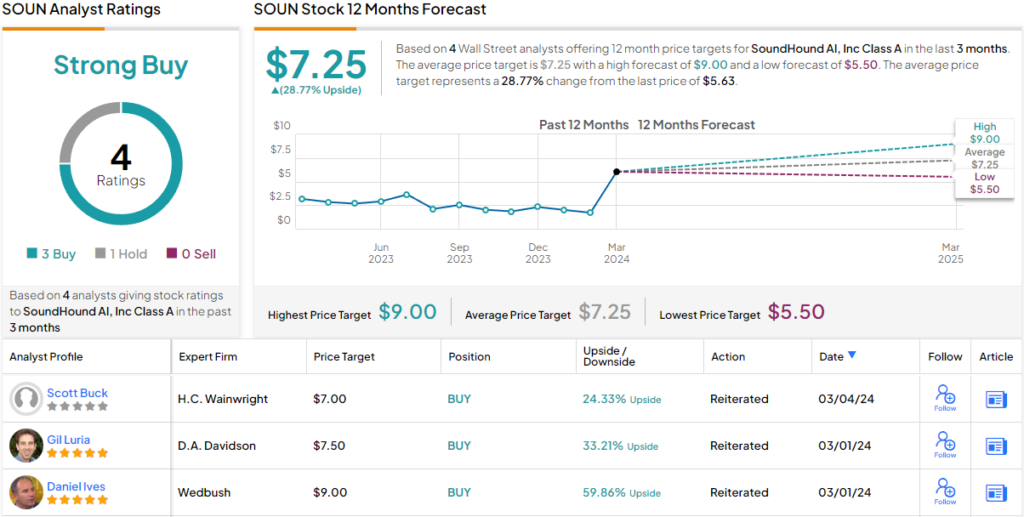

Accordingly, Buck rates SOUN shares a Buy, while raising his price target from $5 to $7, implying the stock will climb 24% higher in the months ahead. (To watch Buck’s track record, click here)

Overall, SOUN boasts a small yet vocal camp of bullish analysts. With 3 Buy ratings and 1 Hold received in the last three months, SOUN stock maintains a Strong Buy consensus rating. Additionally, its $7.25 average price target puts the potential twelve-month gain at ~29%. (See SoundHound AI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.