2023 was a great year for chip stocks. While the main indexes all saw out the year conclusively in the green, the PHLX Semiconductor Index – the main industry barometer – recorded market beating gains of 65%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yet, after such a robust performance, should investors be seeking alternative untapped market opportunities? In short, the answer seems to be ‘no,’ according to UBS’ Timothy Arcuri, a top analyst who, based on his stock recommendations, ranks fifth among the thousands of Wall Street stock experts.

“Even after this rally into year-end, we would remain overweight semis in 2024 as inventory has peaked and started converting to revenue,” the 5-star analyst opined. “Stocks have worked the past four cycles when revenue growth starts to outpace inventory growth and that should be the case through much, if not all, of 2024.”

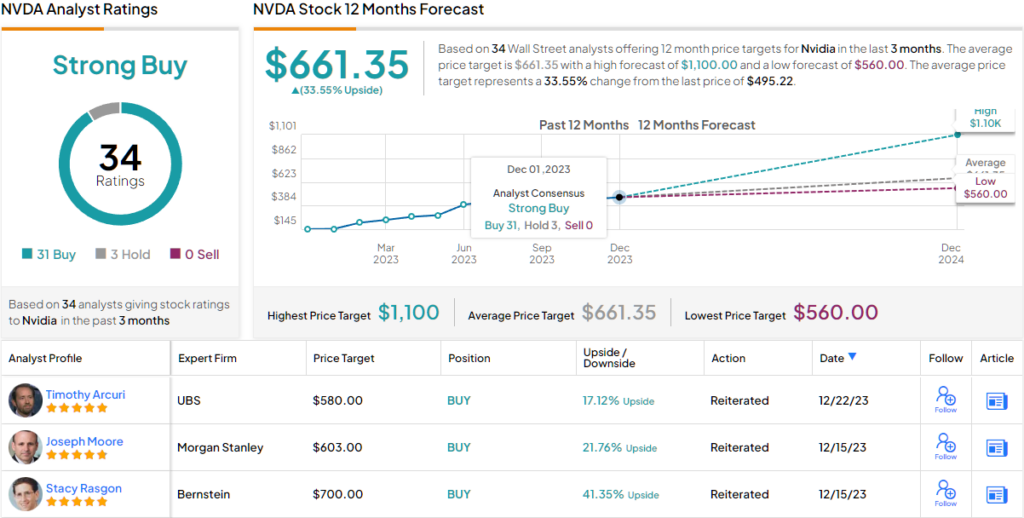

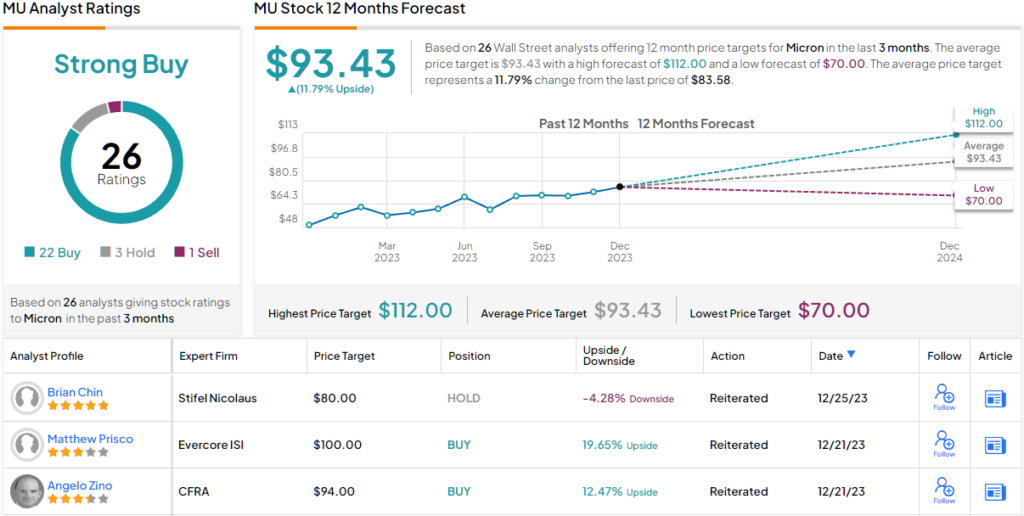

Amongst the names Arcuri thinks investors should keep leaning into are Nvidia (NASDAQ:NVDA) and Micron (NASDAQ:MU) – two chip giants that outperformed the overall strong semi display last year. But it’s not only the UBS analyst who thinks these names should remain in investors’ portfolios right now. According to the TipRanks database, both are also rated Strong Buys by the analyst consensus. Let’s give them a closer look.

Nvidia

If there’s one stock that can be called the shining star of 2023’s bull market, it is Nvidia. The gains came free and easy (all 240% of them) as the semi giant delivered a series of earnings reports that had Wall Street gasping in amazement. There were beat-and-raises galore, as the company became one of the prime beneficiaries of the rise of AI. The reason for that is pretty simple: Nvidia has practically cornered the market for the AI chips used in data centers that power the tech, with its best-in-class offerings selling by the bucketload.

An overview of the most recent quarterly readout paints the picture. With Data Center revenue posting a year-over-year increase of 279% to reach a record $14.51 billion, overall revenue in the fiscal third quarter totaled $18.12 billion, amounting to a 205.6% y/y uptick, as the figure trumped Street expectations by $2.01 billion. Adj. net income rose by nearly 600% from the same period a year ago to reach $1.46 billion, translating at the bottom-line to adj. EPS of $4.02, $0.63 higher than the analysts’ forecast. Moving forward, Nvidia anticipates FQ4 revenue will reach $20 billion, plus or minus 2%, implying growth of nearly 231% and easily outpacing consensus at $17.82 billion.

But given how successful Nvidia has been over the past year, might it have already reached the peak of its powers? That is a topic that has entered the conversation, admits Arcuri, although he doesn’t think the time to move elsewhere has arrived just yet.

“To some degree, the debate on ‘peak’ will remain alive and well and drive further compression in the multiple especially as NVDA’s ~$75B compute revenue next year will be at least 25% of data center capex (~50% of all compute spend) – a huge number given other parallel priorities for many companies,” Arcuri explained. “That said, NVDA sure sounds confident on sustained growth – and it makes sense to us as waves of growth are starting to build with horizontal enterprise software companies starting to embed NVDA AI into their platforms to take out into the world and broaden the NVDA ecosystem. Net/net, we think it is still too early to get off this train – especially as NVDA becomes the de-facto global platform for what might be one of the most transformational technologies of our lifetime (AI).”

To this end, Arcuri rates NVDA shares a Buy while his $580 price target suggests the stock has room for further growth of 17% in the year ahead. (To watch Arcuri’s track record, click here)

Most other Street analysts also remain firmly in Nvidia’s corner. Based on a mix of 31 Buys vs. 3 Holds, the stock claims a Strong Buy consensus rating. The average target is more bullish than Arcuri will allow; at $661.35, the figure makes room for one-year returns of 33.5%. (See Nvidia stock forecast)

Micron

For the second Arcuri pick, we’ll turn to another industry giant. Micron is a leading global semiconductor firm specializing in the design, manufacturing, and marketing of memory and storage solutions. Its expertise lies in the production of two primary categories of memory chips: dynamic random-access memory (DRAM) and NAND. DRAM chips function as the primary memory in devices such as PCs, servers, and various other electronic devices. On the other hand, NAND flash serves the purpose of retaining memory even when power is turned off, providing a means for longer-term data storage in devices like smartphones and solid-state drives.

The semiconductor industry is known for its cyclical nature, and it seems the tide has recently turned in Micron’s favor. After observing several of its peers deliver strong earnings reports, Micron followed suit in its fiscal first quarter (November quarter) print and guide.

Following five quarters of year-over-year revenue declines, growth was on the horizon again as the top-line reached $4.73 billion, marking a 15.6% improvement compared to the same period last year and surpassing analysts’ forecasts by $100 million. On the other end of the equation, adj. EPS of -$0.95 fared better than the consensus estimate – by $0.06.

As for the outlook, Micron is anticipating F2Q revenue of $5.30 billion ± $200 million, well above the Street’s estimate of $5.05 billion. Moreover, the company expects gross margin to reach 13% ± 1.5%, a significant increase compared to consensus expectations of just 4%. Adj. EPS is expected at ($0.28) ± $0.07, also meaningfully better than the analysts’ forecast of ($0.61).

The strong outlook informs Arcuri’s bullish take for Micron. “Better than expected gross margin guidance and an even more confident tone on pricing in C2024 should keep MU moving higher and it remains one of our top ideas for ’24,” the analyst confidently said. “Valuation is richer than prior cycles, but who knows how strong this next upturn could be and fundamentals are to some degree still being held back by lingering oversupply of old products.”

“This also creates a very low baseline for pricing as mix continues to shift to newer products with much tighter supply. To that end, the most important new development here is that MU is already getting pre-payments for products made on leading edge process nodes where capacity has quickly become very tight. These new AI-related demand vectors are also much less capacity efficient meaning that demand is moving up and supply is effectively still coming down – a very potent cocktail that can keep pricing moving higher well into and maybe through C2025,” Arcuri went on to add.

Quantifying his stance, Arcuri rates Micron shares a Buy, alongside a $95 price target. Should the figure be met, investors will be pocketing returns of 11% a year from now.

Over the past 3 months, 26 analysts have waded in with MU reviews and these break down into 22 Buys, 3 Holds and 1 Sell, all culminating in a Strong Buy consensus rating. Analysts see shares appreciating by 9.5% in the months ahead, considering the average target stands at $93.43. (See Micron stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.