SoFi Technologies (NASDAQ:SOFI) delivered another solid performance with its Q3 2025 earnings, setting records left and right. SoFi grew revenues by 38% year-over-year to reach a new peak of $950 million, while its Adjusted EBITDA of $277 million was also a new company high.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company has long since bid a fond farewell to its salad days when it was focused on refinancing student loans, and now boasts some 12.6 million members and over 18.5 million products. SOFI has also demonstrated additional signs that its business is maturing, simultaneously setting a new record for loan originations with $9.9 billion in Q3 while also decreasing its Personal Loan net charge-offs by 23 basis points.

SOFI’s share price has surged upward by over 130% during the past six months, reflecting the market’s enthusiasm for the fintech company. With this white-hot growth in the rearview mirror, is it time to take the foot off the gas pedal?

Not necessarily, explains one top investor known by the pseudonym Stone Fox Capital.

“SOFI remains in early growth stages, with long-term potential to become a top 10 U.S. financial institution,” predicts the 5-star investor, who is among the top 3% of investors covered by TipRanks.

Stone Fox is encouraged by the company’s shift into more of a fee-based structure, which allows for more predictable and recurring sources of revenue. In fact, 43% of SOFI’s revenues now come from fee-based services, a 50% year-over-year increase.

The investor notes that SOFI could hit $5.2 billion in sales by 2027, though this is admittedly a far cry from the total assets of the country’s top 10 banks. However, Stone Fox reminds investors that SoFi has designs on breaking into this club in the years ahead.

The investor does caution against being too aggressive at present, as SOFI’s share price could take a breather after such fast growth earlier this year. Still, any bumps in the road ahead could serve as a good opportunity to increase one’s position in SOFI, concludes Stone Fox.

“SoFi is still very early in the growth phase,” emphasizes the investor, who rates SOFI a Strong Buy. (To watch Stone Fox Capital’s track record, click here)

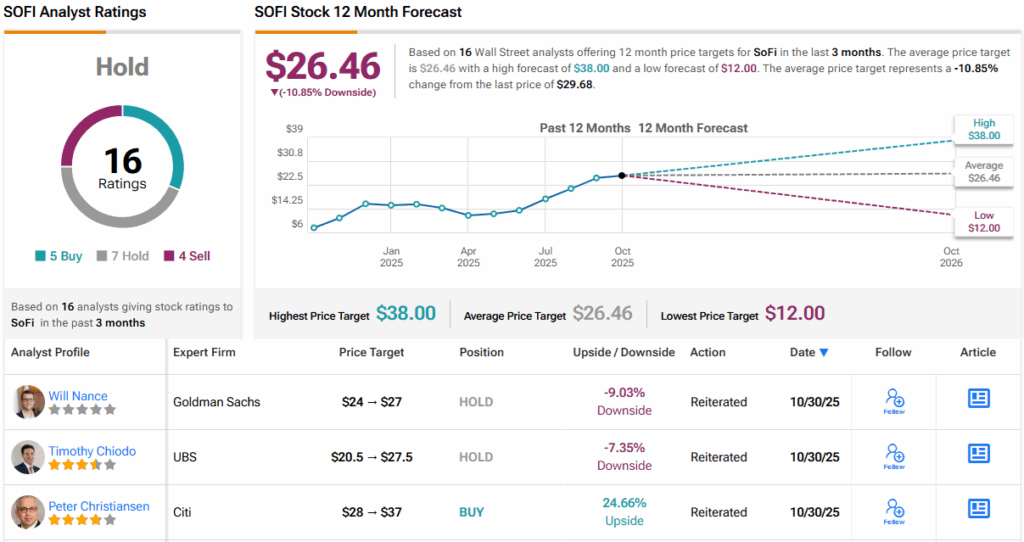

As a whole, Wall Street isn’t quite as upbeat as Stone Fox. With 5 Buys, 7 Holds, and 4 Sells, SOFI carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $26.46 implies a downside of roughly 11%. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.