JPMorgan Chase (JPM) stock is in the spotlight after the banking giant’s strong Q3 earnings prompted several Wall Street analysts to raise their price targets. Despite the strong results, JPM stock slipped 1.91% on Tuesday but rebounded 1.21% in pre-market trading on Wednesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, JPMorgan reported a 12% year-over-year profit increase, while revenue rose 9%. The better-than-expected results were driven by strong performance in the trading division, a rebound in investment banking fees, and steady consumer demand under President Donald Trump’s administration.

Goldman Sachs Lifts JPM Price Target to $366

Goldman’s five-star-rated analyst Richard Ramsden raised his price target on JPM from $350 to $366. Ramsden highlighted that JPMorgan’s updated 2025 net interest income guidance of $92.2 billion (excluding Markets) reflects stronger balance sheet growth and an improving loan environment.

He believes the outlook remains achievable despite some pressure on net interest margins.

Morgan Stanley Sticks to Hold Rating over Valuation

Four-star-rated analyst Betsy Graseck at Morgan Stanley raised her price target on JPM to $338.00 from $336.00. Graseck expects JPMorgan’s return on tangible common equity (ROTCE) — a key measure of profitability — to reach around 21% by 2027, with estimates ranging between 20% and 22% over the next three years. Notably, JPMorgan achieved a ROTCE of 20% in Q3 2025.

She further noted that the optimism comes from expectations of a continued recovery in capital markets, more mergers and acquisitions activity, strong credit card lending, and manageable credit losses in the coming years.

Meanwhile, Graseck sticks with a Hold rating on JPM as she believes the stock is fairly valued, describing its current price as “full.” She still expects roughly 12% upside, driven by earnings growth rather than higher valuation multiples.

Barclays Weighs In on JPM Stock

Barclays’ five-star-rated analyst Jason Goldberg raised JPM’s price target to $342 from $330, maintaining a Buy rating.

He noted that while the company posted a Q3 earnings beat, its momentum into 2026 may face headwinds from higher expenses.

Is JPM stock a Buy, Sell, or Hold?

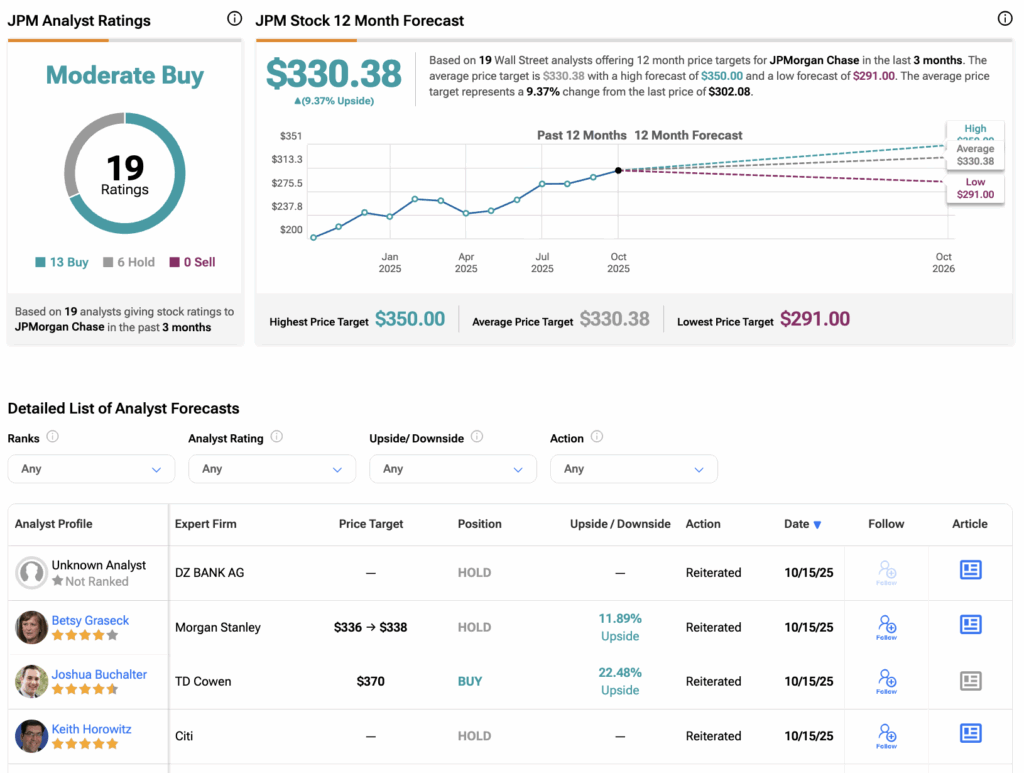

According to TipRanks, JPM stock has received a Moderate Buy consensus rating, with 13 Buys and six Holds assigned in the last three months. The average stock price target for JPMorgan Chase is $330.38, suggesting a potential upside of 9.37% from the current level.