JPMorgan has shaken things up in the airline sector by suggesting that big-name carriers like American Airlines (AAL), Delta Airlines (DAL), and United Airlines (UAL) are now outshining discount airlines. Analyst Jamie Baker points out that the “Big Three” have been showing impressive revenue guidance and solid margins. He believes it’s a mistake to think that low-fare airlines are safe from fierce competition just because of their cost advantages, particularly with the emergence of basic economy options. Baker also stressed that capital, aircraft, and pilots – the three crucial elements in the sector – pose unique challenges for discount carriers.

As a result, JPMorgan has downgraded Frontier Group (ULCC) and Southwest Airlines (LUV) to Neutral from Overweight, citing the ongoing struggles faced by discount airlines. While Southwest has a history of profitability, a sturdy balance sheet, and a loyal customer base, it’s been facing operational hiccups lately, which have impacted its share price and tested the patience of investors.

Moreover, airlines with more international exposure are predicted to outperform Southwest in the short term. On the other hand, JPMorgan has upgraded American Airlines to Overweight from Neutral and raised their 2024 EPS estimate from $2.50 to $3.00. The firm sees revenue momentum and margin strength leaning in favor of the “Big Three,” with balance sheet worries not as concerning as they once were.

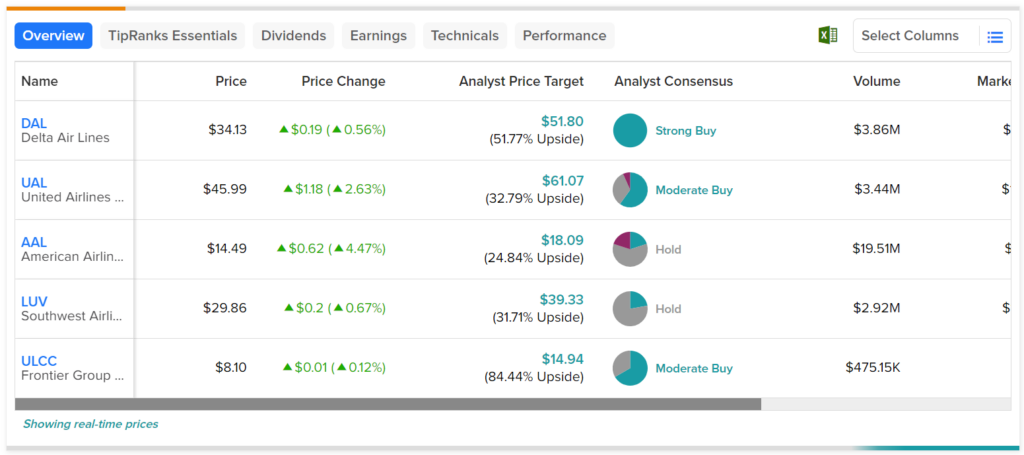

Overall, analysts appear to have the highest expectation for ULCC stock based on its average price target of $14.94 per share, which implies over 84% upside potential.