The notion of generative artificial intelligence (AI) can be a tricky thing to deal with. Some believe it will create a paradise of constant engagement and challenging work as opposed to drudgery and busywork. Others believe it is the first step to mass firings. Regardless of what the ultimate outcome will be, JPMorgan Chase (JPM) is embracing AI, a move that was moderately pleasing to shareholders who sent shares up fractionally in Friday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JPMorgan is turning to a new tool called LLM Suite, which is built by the same operation that built ChatGPT: OpenAI. LLM Suite is designed to accomplish a range of simple tasks, including writing emails and reports. So far, over 60,000 of JPMorgan’s employees have access to the AI tool, and some expect it to be as available as a videoconferencing program is.

JPMorgan designed the tool to take advantage of the large language models (LLMs) already in use. Instead of being stuck with a single LLM, JPM will have the ability to switch between multiple models depending on the use case. This creates a versatile tool that saves the company time and resources from having to develop its own model from scratch.

The CEO Showdown

Meanwhile, JPMorgan is having some internal drama of its own as potential replacements for Jamie Dimon are considered. Reports note that the current competition is “remarkably intense,” with challengers coming in from all over. Some of the potential CEOs are even starting to lay out their plans for the future, which include developing internal talent to serve as future leaders as well as ways to gain further market share.

Is JPMorgan Stock a Buy Now?

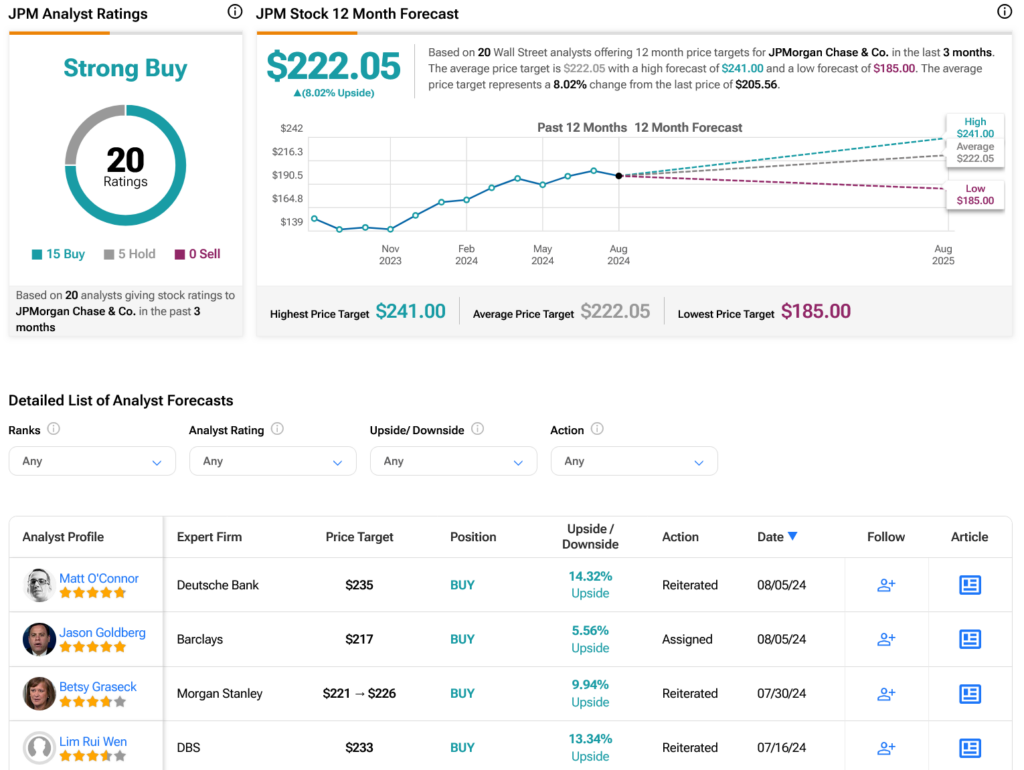

Turning to Wall Street, analysts have a Strong Buy consensus rating on JPM stock based on 15 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 37.24% rally in its share price over the past year, the average JPM price target of $222.05 per share implies 8.02% upside potential.