JPMorgan Chase (JPM) has introduced a new generative AI tool called LLM Suite, based on OpenAI’s ChatGPT, according to an internal memo obtained by the Financial Times. The bank is providing this tool to employees in its asset and wealth management division.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The LLM Suite assists with a variety of tasks, including writing, idea generation, spreadsheet problem-solving, and document summarizing. However, the memo notes that the tool does not have specialized knowledge of the asset and wealth management division and is intended for general productivity improvements.

AI in Banking

Major banks are experimenting with AI to boost productivity and reduce costs. According to a Bloomberg report, JPMorgan’s CEO Jamie Dimon, a strong advocate for AI, stated earlier this year in an episode of “The Circuit with Emily Chang” that AI technology will be integrated into all bank processes, including trading, research, equity hedging, and customer service.

Citigroup (C) predicts that AI could add $170 billion to the banking industry by 2028, but it might also lead to automation of 54% of banking jobs, which could result in job losses. To harness AI’s potential, Citigroup is allowing its 40,000 coders to experiment with various AI technologies. Additionally, the bank is using AI to review regulatory proposals. Meanwhile, Deutsche Bank (DB) is employing AI to analyze the investment portfolios of wealthy clients.

Is JPM a Buy, Hold, or Sell?

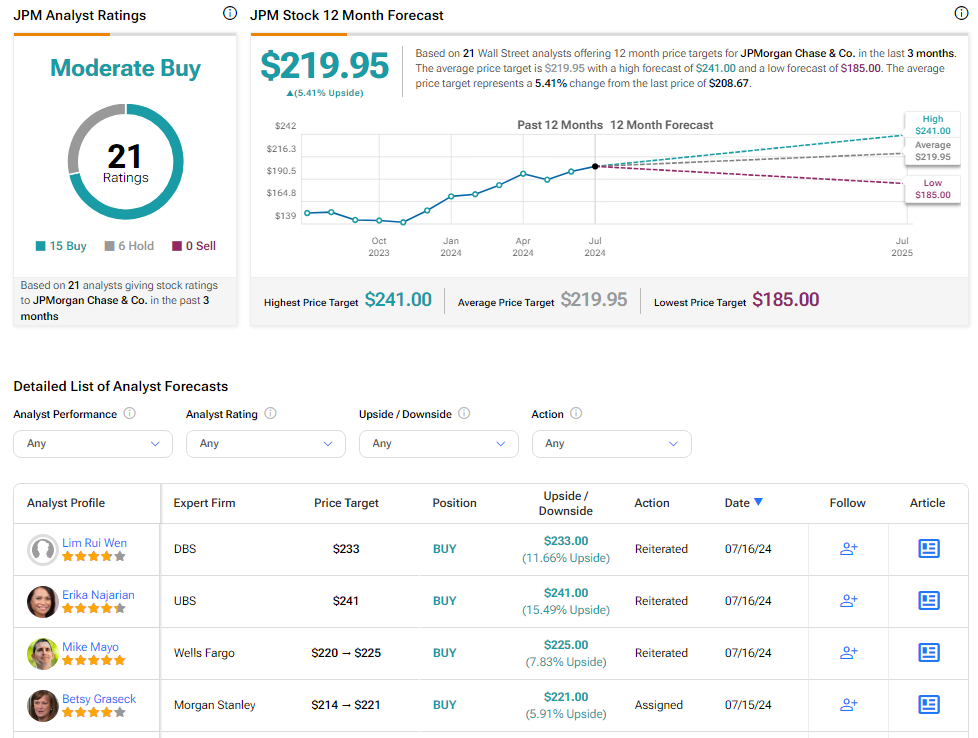

Analysts remain cautiously optimistic about JPM stock, with a Moderate Buy consensus rating based on 15 Buys and six Holds. Over the past year, JPM has increased by more than 30%, and the average JPM price target of $219.95 implies an upside potential of 5.4% from current levels.