Banking giant JP Morgan & Chase Co. (NYSE:JPM) went up in pre-market trading even as the bank’s Q4 earnings declined by 15% year-over-year to $3.04 per share. This was below consensus estimates of $3.35 per share. The bank’s Q4 profit took a hit as it had to pay a fee of $2.9 billion as part of the government’s acquisition of failed regional banks last year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Large U.S. banks, like JP Morgan, faced a special assessment from the Federal Deposit Insurance Corporation (FDIC) to replenish losses in a fund aiding uninsured depositors of seized regional banks. This is what led to the $2.9 billion fee.

JP Morgan’s revenues in the fourth quarter were $39.94 billion, up by 12% year-over-year, ahead of Street estimates of $39.7 billion. JP Morgan CEO Jamie Dimon announced record full-year results with revenues of $158.1 billion, a jump of 23% year-over-year. Dimon credited strong performance in net interest income and credit quality for the strong results. The bank achieved nearly $50 billion in profit in 2023, with $4.1 billion from First Republic.

Dimon remained cautious about the global economy as different risks remained, including central banks scaling back support programs and geopolitical tensions in Ukraine and the Middle East. However, the CEO pointed out that the U.S. economy remained resilient but warned of potential challenges like persistent inflation and higher rates due to deficit spending and supply chain adjustments.

Is JPM Stock a Buy, Sell, or Hold?

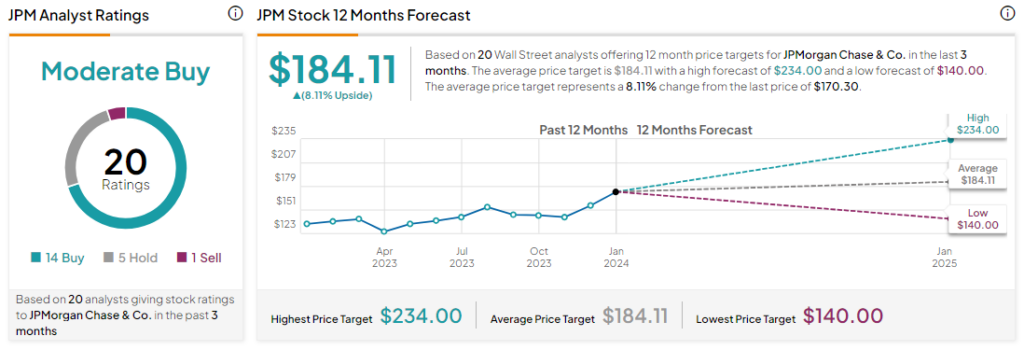

Analysts remain cautiously optimistic about JPM stock with a Moderate Buy consensus rating based on 14 Buys, five Holds, and one Sell. Over the past year, JPM stock has jumped by more than 20%, and the average JPM price target of $184.11 implies an upside potential of 8.1% at current levels.