Banking giant JP Morgan Chase (NYSE:JPM) reported strong earnings in the third quarter of $4.33 per share, beating analysts’ estimates of $3.95 per share. The bank’s net revenues surged by 21% year-over-year to $40.7 billion in Q3, again exceeding Street estimates of $39.6 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

These quarterly results also included First Republic’s results, which the bank acquired in May. JPM’s net interest income jumped by 30% year-over-year to $22.9 billion in Q3, “driven by higher rates and higher revolving balances in Card Services.”

The bank had a provision for credit losses of $1.4 billion, reflecting “net charge-offs of $1.5 billion and a net reserve release of $113 million.”

JP Morgan Chase’s Chairman and CEO, Jamie Dimon, warned that although consumers are generally healthy, they are spending down their excess cash buffers. In addition, he went on to say that the tight labor market and high government debt levels are increasing the risk that inflation remains high, causing interest rates to rise further from current levels.

Looking forward, the bank’s adjusted expenses are estimated to be around $84 billion in FY23. At the same time, the card services net charge-off rate (NCO) is likely to be approximately 2.5% as compared to its previous outlook of around 2.60%. JPM expects a net income of $88.5 billion in FY23, higher than its prior guidance of $87 billion earlier this year.

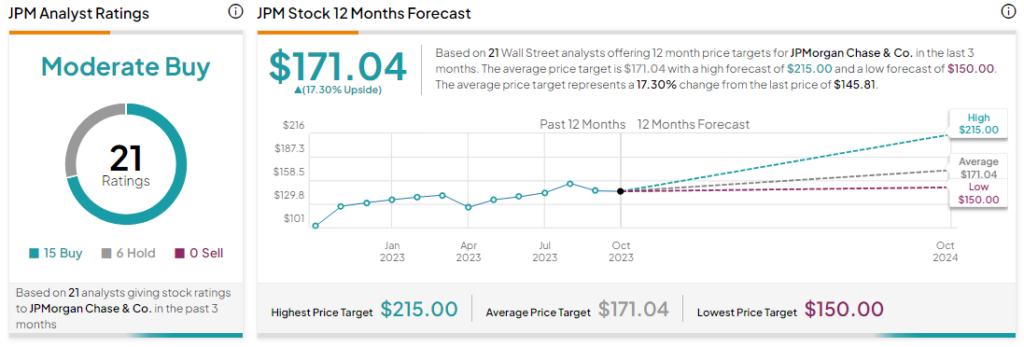

Is JPM a Buy, Sell, or Hold?

Analysts are cautiously optimistic about JPM stock, with a Moderate Buy consensus rating based on 15 Buys and six Holds. The average JPM price target is $171.04, implying an upside potential of 17.3% from current levels.