Shares of American pharmaceutical heavyweight Johnson & Johnson (JNJ) started Monday trading on a dull note as the U.S. health regulator sanctioned a warning label to be added to its cancer therapy medication. This is even as the New Jersey-based company is set to release its third quarter results tomorrow.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Reuters, the U.S. Food and Drug Administration (FDA) on Friday gave a go-ahead for a note warning that Carvykti could have a fatal impact on the stomach or intestines to be added to the medication’s label. It is the strictest warning the FDA can give for a medicine.

Carvykti is a cell-based medication that was jointly developed by Johnson and Johnson and Legend Biotech (LEGN) to treat multiple myeloma, a blood cancer that affects the bone marrow. The intravenous medication received FDA’s approval in March 2022.

Side Effect of Johnson & Johnson’s Cancer Therapy?

Carvykti is administered as part of CAR-T. This is a type of cancer treatment where a patient’s own immune cells (T-cells) are taken out, undergo genetic modification in a lab to make them recognize and attack cancer cells, and then are transferred back into the patient’s body.

However, FDA said it approved the warning after obtaining reports that some patients developed IEC-EC after being treated with the intravenous infusion. IEC-EC is a type of bacterial infection that affects the guts and can cause diarrhea, stomach pain, and fever. Nonetheless, the FDA maintains that the overall benefit of the medication still surpasses the risks.

Johnson & Johnson’s Q3 Results at the Door

Meanwhile, in its upcoming quarter, Wall Street expects Johnson and Johnson to generate $23.76 billion in revenue. The company is also expected to earn about two dollars and 76 cents per share. This is even as JNJ stock has managed to hold up in a bearish market for healthcare stocks.

Is JNJ a Good Stock to Buy Now?

Since the start of the year, Johnson & Johnson’s shares have jumped about 35%. However, Wall Street is only moderately bullish about the stock.

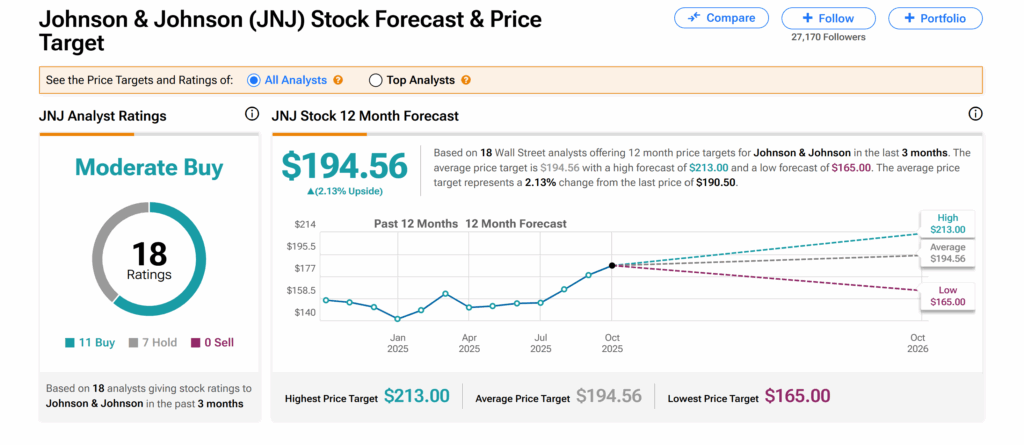

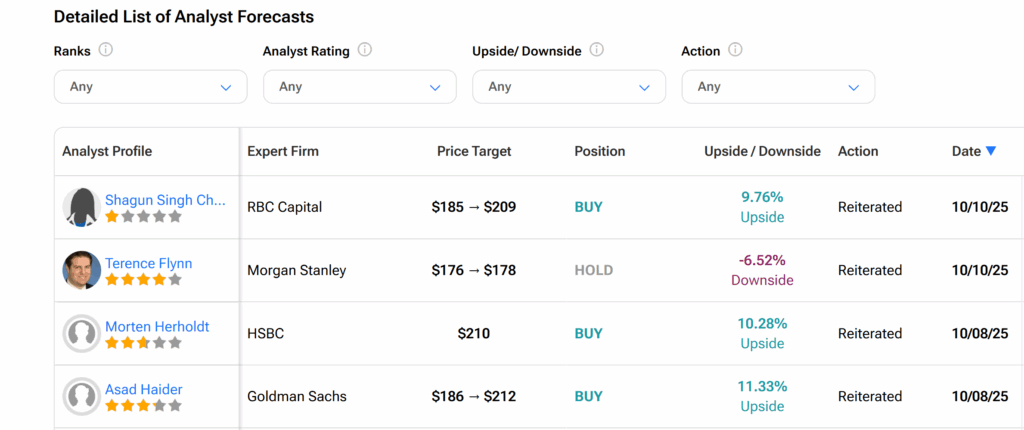

On Tip, JNJ stock has a Moderate Buy consensus rating. This is based on 11 Buys and seven Holds assigned by 18 Wall Street analysts over the past three months.

Moreover, the average JNJ price target of $194.56 suggests a 2% growth potential from the current level.