Despite healthcare stocks underperforming in recent years, Johnson & Johnson (JNJ) has stood out, climbing 31% so far in 2025, reaching its all-time highs, and bucking the broader market trend. After years of lagging behind the market, weighed down by lawsuits and billions in write-offs, JNJ’s strategic shift—spinning off its over-the-counter business and focusing on Pharma and high-growth MedTech segments—has fueled this year’s bullish spurt, with results already showing up in recent quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The impact of tariffs on the bottom line has been less severe than expected, and a reasonable valuation has put JNJ back on bulls’ radars, with analysts revising recommendations and long-term estimates upward.

However, it’s not all roses for the healthcare giant. The firm is set to report its third-quarter earnings on October 14, which could be a pivotal moment for the thesis. Strong trends in MedTech and potential updates to guidance may consolidate multiple expansions and even push the stock toward new all-time highs, supporting my Buy rating.

From Consumer Distractions to Healthcare Focus

Johnson & Johnson has undergone a major business transformation, now focusing solely on healthcare with a stronger emphasis on high-value pharmaceuticals and “MedTech,” and reducing distractions from secondary businesses. For example, the spin-off of Kenvue (KVUE), its over-the-counter division, removes low-growth consumer products with tight margins and legal risks, allowing management to focus on the core healthcare business.

MedTech, now the company’s growth engine, accounts for 36% of total sales, driven in large part by recent acquisitions like Abiomed and Shockwave Medical (~$17 billion and $13 billion, respectively). This segment provides more sustainable growth, is less exposed to patent cliffs and pharma-related legal risks, and adds resilience to the overall business.

Even with patent losses—like its blockbuster rheumatology drug STELARA, which saw about a 43% sales drop (already anticipated)—J&J has offset declines with gains elsewhere. TREMFYA in immunology grew ~30% in Q2, while oncology sales rose 21% in the first half of the year, fueled by a robust pipeline.

Looking at oncology in particular, CEO Joaquin Duato projects that J&J will be the global leader by 2030, targeting $50 billion in annual sales. Analysts have responded by raising top-line growth forecasts through 2030, now anticipating a five-year CAGR of 5.3%, up from 4.7% two quarters ago.

Bottom-line expectations have also improved, with the five-year EPS CAGR now at 7.2%, versus 5.9% previously. These upgrades reflect not only the business transformation but also a more favorable outlook on tariffs and talc litigation—historically a major overhang—which is now being resolved on a case-by-case basis with positive results.

JNJ Stock Looks Strong Heading Into Q3

J&J’s quarterly earnings are just around the corner, and expectations for a strong quarter are high. The market currently estimates EPS of $2.75, implying a notable 14% year-over-year increase, with revenues projected at $23.74 billion, or 5.6% growth. These expectations are supported by the previous earnings release, when J&J’s management updated guidance, raising annual EPS to $10.80–$10.90 (up 8.7% YoY) and revenues to $93.44 billion (up 5.2% YoY).

Looking at historical trends, consistently beating earnings estimates hasn’t always triggered a strong stock reaction. What seems to move the needle more is an upward revision in guidance, as we saw in the last quarter. This suggests that simply beating estimates in Q3 may not be enough to spark a bullish response—any immediate upside could be more speculative unless accompanied by another guidance raise.

More specifically, I’d keep a close eye on margins, especially since J&J’s management is targeting operating margins of around ~28% annually—driven by the shift toward higher value-added segments and a much more moderate impact from tariffs (estimated at around $200 million). Along those lines, combined with potential FX tailwinds, I see room for upside surprises that could reinforce—or even lead to an upward revision of—that target, which would be a strong catalyst for J&J’s bullish thesis.

How JNJ’s Growth Drives Its Price Action

Trading at 17.4x its forward earnings, JNJ currently sits at a premium compared with its five-year average of 15.6x. This year has been particularly interesting: back in January, JNJ hit its lowest multiple in that period at 13x forward earnings, and now it trades close to the previous peak, reaching 18.2x at the end of 2022.

Arguably, this multiple expansion has closely tracked the improvement in the company’s growth outlook, the resilience of its product portfolio, and the visibility of high-potential pipelines—especially in oncology and MedTech.

This setup suggests two key dynamics—limited capacity for further upside and a modest, though possible, risk of correction. I favor a scenario of gradual consolidations over a sharp decline, supported by technical indicators. JNJ’s share price remains well above its 200-day SMA ($189 vs. $160) after a strong run since July. Such momentum often attracts institutional buyers and trend-following algorithms, which can drive a re-rating of valuation multiples, especially when forward earnings estimates are being revised upward, as they currently are.

Is JNJ a Buy, Hold, or Sell?

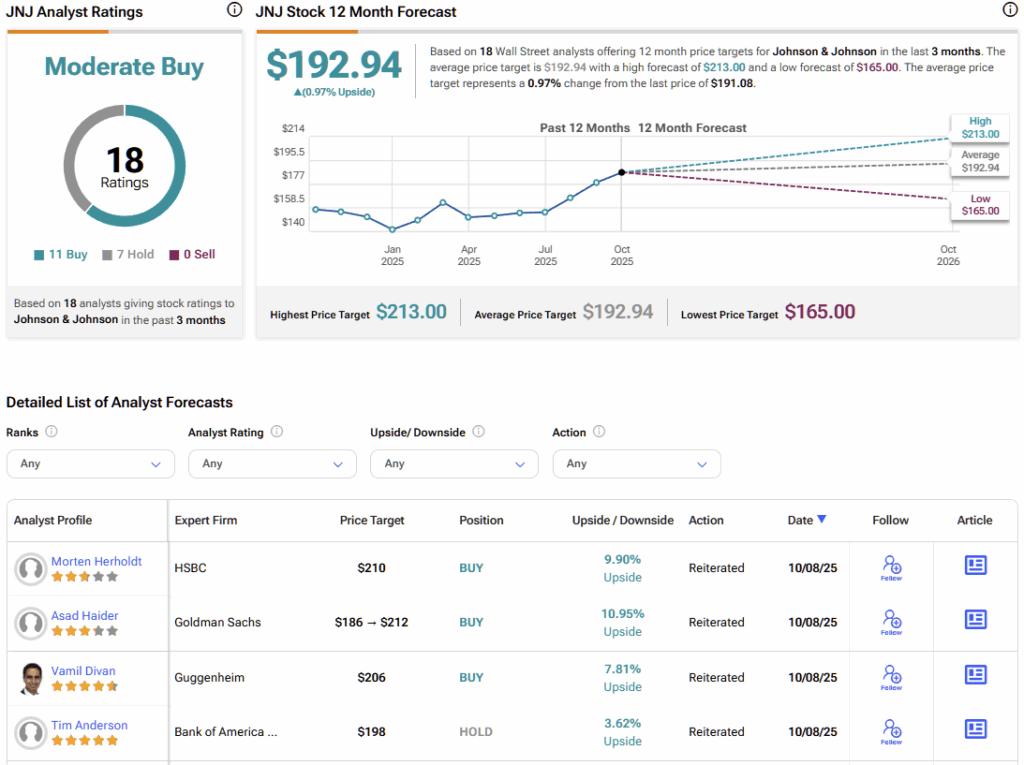

The consensus among analysts on JNJ is mostly bullish, though there’s some room for moderation. Of the 18 analysts covering the stock over the past three months, 11 recommend Buy, while seven recommend Hold. The average price target sits at $192.94, suggesting virtually no upside from the current share price.

On Track for Growth and Momentum

The odds favor Johnson & Johnson ahead of its earnings day, with the stock seemingly engaged in a sustainable scenario of multiple expansion due to a revitalized business model and consistently upwardly revised expectations.

Even on its all-time highs, I do not believe this is the time to take our foot off the accelerator, believing that an eventual delivery of top and bottom line targets above forecasted, or even guidance increases with real room to occur in H2, could be the basis for JNJ to finally trade at a richer multiple going forward. Therefore, I rate JNJ as a Buy for now.