Shares of technology and multi-industrial company Johnson Controls (JCI) have surged 30.5% over the past year. Amid supply chain bottlenecks and labor market challenges, JCI recently reported better-than-estimated performance for the first quarter on both top-line and bottom-line fronts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue increased 10% year-over-year to $5.9 billion, outperforming estimates of $5.1 billion. Earnings per share at $0.54 came in ahead of expectations of $0.47. Notably, while the company carried out share buybacks worth $500 million during the quarter, it also hiked its dividend by a robust 26%.

With these developments in mind, let us take a look at the changes in JCI’s key risk factors that investors should know.

Risk Factors

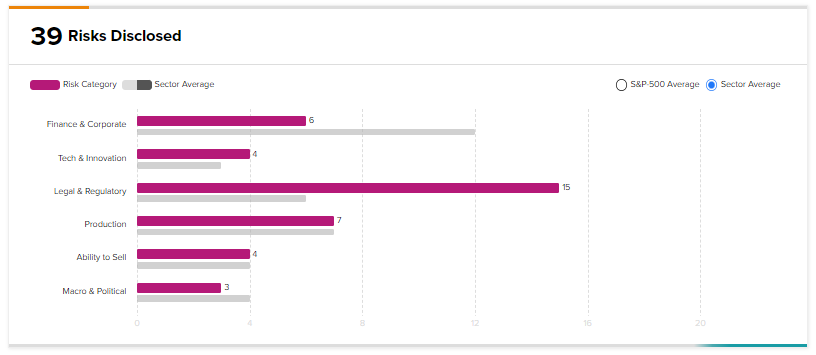

According to the TipRanks Risk Factors tool, Johnson Controls’ top risk category is Legal & Regulatory, contributing 15 of the total 39 risks identified for the stock.

In its recent report, the company has changed one key risk factor under the Macro & Political risk category.

JCI noted that the COVID-19 pandemic has affected and may continue to affect its offices, manufacturing and servicing facilities, as well as its distribution centers. While the company has modified its business practices to mitigate these challenges, the risk remains that these and any future changes may mean higher costs, lower productivity, and business disruptions for JCI.

Compared to a sector average of 6 Legal & Regulatory risk factors, JCI’s is at 15.

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in Johnson Controls by 4.4 million shares in the last quarter, indicating a very negative hedge fund confidence signal in the stock based on activities of 10 hedge funds. Notably, Ray Dalio’s Bridgewater Associates has a holding worth about $69.66 million in JCI.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Activision Blizzard Reports Dissapointing Q4 Results

Snap Delivers Stellar Q4 Results; Shares Skyrocket 59% After Hours

GameStop Partners with Immutable X For NFT Marketplace