Shares of building solutions provider Johnson Controls (NYSE:JCI) are tanking in the early session today after the company’s fourth-quarter results lagged expectations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite a 2.7% year-over-year increase, revenue of $6.91 billion missed estimates by $190 million. Further, EPS of $1.05 missed the cut by $0.04. During the year, the company experienced robust order growth in its Install and Service businesses. In the fourth quarter, orders increased by over 9%, and order backlog at the end of the quarter stood at a record $12.1 billion.

The company achieved higher sales in the North America, EMEA, and Latin America regions. However, sales in the Asia Pacific region declined due to weakness in the Chinese market. Looking ahead to Fiscal Year 2024, JCI expects an improvement of over 25 basis points in its adjusted segment EBITDA margin. In addition, adjusted EPS for the year is anticipated to be between $3.65 and $3.80.

For the upcoming quarter, the company expects an adjusted EBITDA margin of around 13%. Furthermore, adjusted EPS is seen hovering between $0.48 and $0.50.

Is JCI a Good Investment?

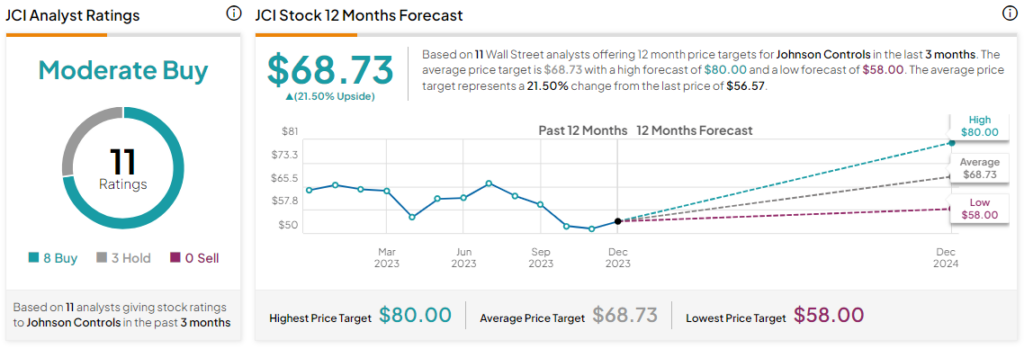

Overall, the Street has a Moderate Buy consensus rating on Johnson Controls. Following a nearly 11% drop in the company’s share price over the past year, the average JCI price target of $68.73 implies a 21.5% potential upside.

Read full Disclosure