There’s an unexpected problem that’s emerged for airline stocks JetBlue (NASDAQ:JBLU) and Spirit Airlines (NYSE:SAVE), and it stems from its current trial against the Justice Department. Despite the fourth week of the trial about to end tomorrow, one vital word seems to be missing from the proceedings: settlement. That’s sparked a 3.75% loss for JetBlue, and just over a 6% loss for Spirit in Tuesday afternoon’s trading.

It’s proven quite unexpected, but the Department of Justice hasn’t actually reached out yet with any kind of settlement offer, which is highly unusual for a case like this. In fact, both JetBlue and Spirit have already made it clear that they’re willing to settle, but the DoJ so far isn’t biting. Some were speculating that said talks were to come last Friday, but those never seemed to arrive. Spirit and JetBlue were planning a merger not so long ago, even to the point where they engineered divestiture plans, but those plans were never put in place and they never seemed to mollify the DoJ.

A Merger Would Make Travel Less Attainable and Less Accessible

So why is the government so hesitant to make a deal? One report might actually have the answer here: a recent opinion piece from Anna Eskamani, a member of the Florida House of Representatives. Eskimani declared that a merger between JetBlue and Spirit Airlines would actually be bad for Floridians. Since Spirit Airlines is actually the largest in the ultra-low-cost airline segment, losing Spirit to a merger with JetBlue would leave somewhere around half of the ultra-low-cost airline market out in the cold. That in turn, Eskimani asserts, would make travel less attainable and less accessible. That might suggest a common thread in the government, and also explain why it’s not looking to make a deal with Spirit and JetBlue.

Which Airline Stocks are a Good Buy?

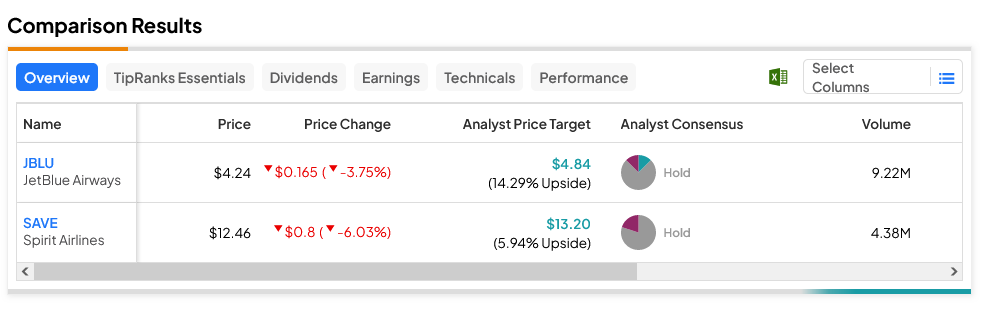

Turning to Wall Street, SAVE stock is proving the laggard and the hardest hit. Both SAVE and JBLU are considered Holds, but JBLU stock’s average price target of $4.84 gives it 14.29% upside potential. Meanwhile, SAVE stock offers 5.94% upside with an average price target of $13.20 per share.