In yet another twist to the relentless persuasion by JetBlue Airways (JBLU) (DE:JAW) (GB:0JOT) to acquire Spirit Airlines (SAVE) (S64) (OL8U), the former has once again raised its offer to drive away its opponent, Frontier Group Holdings (ULCC) (OVN).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the news, shares of Spirit Airlines were up almost 5% while JetBlue shares remained flat during the extended trading hours on June 27.

Ahead of the upcoming vote at the Spirit special meeting scheduled to be held on June 30, which seeks approval for the deal with Frontier Group Holdings, JetBlue appealed to Spirit shareholders to not get misled by the Spirit Board and to not favor the inferior deal made by Frontier.

Enhanced Takeover Deal by JetBlue

In an open letter to the shareholders of Spirit Airlines, JetBlue laid down the benefits of its clearly superior proposal and also gave justification for the recent misleading statements made by Spirit.

According to the latest revised offer, JetBlue proposed paying a reverse breakup fee to Spirit (if the transaction falls apart due to antitrust reasons) of $400 million versus the $350 million committed earlier.

JetBlue also stated that it will prepay $2.50 per share upon approval of the deal as a cash dividend, compared to $1.50 per share pledged previously.

Furthermore, JetBlue added a ticking fee mechanism wherein shareholders will get a monthly prepayment of $0.10 per share between January 2023 and the consummation or termination of the transaction for an aggregated ticking fee of up to $1.80 per share. This, combined with the initial $1.15 per share, will offset the reverse breakup fee or the merger consideration.

Overall, with the current modifications, the total consideration goes up to $34.15 per share if the deal goes through and $4.30 per share if the deal does not materialize, depending on the duration of the review process.

JetBlue’s CEO Weighs In

JetBlue CEO, Robin Hayes, commented, “Spirit shareholders should not be misled by Spirit and Frontier’s rosy projections of a potential future stock price, which are based on highly flawed assumptions that fail to account for the actual market conditions, including the need for pilot pay increases and elevated fuel costs.”

He further added, “The entrenched Spirit Board has approved a revised deal that is ultimately better for Frontier and its controlling shareholder than it is for Spirit shareholders.”

Spirit’s Take

On June 24, Spirit announced that it planned to go ahead with the deal with Frontier after the latter added an incremental $2 per share to the initial offer. Frontier also further increased the breakup fee to $350 million and offered a $2.22 per share upfront payment.

The Spirit Board prefers Frontier over JetBlue since it is doubtful whether antitrust regulators will approve a merger with JetBlue. The Justice Department is already challenging a partnership between JetBlue and American Airlines Group Inc. (AAL).

Furthermore, Spirit chooses to own shares in a combined Spirit-Frontier entity rather than the all-cash offer by JetBlue. However, JetBlue remains confident of gaining approval to buy Spirit without having to exit its partnership with American.

Frontier’s take

In a letter to Spirit Airlines shareholders yesterday, Frontier Chairman William Franke urged Spirit shareholders to vote for the Frontier deal and said JetBlue’s proposal is unreal and will likely be rejected by antitrust regulators.

Franke stated, “We continue to be excited about the Spirit-Frontier combination, which will create a true nationwide ultra-low-fare airline.”

He further reasoned, “The strategic rationale of a combined Spirit and Frontier remains sound, and the changes we have made to our merger agreement provide greater value for all Spirit stockholders—value that is well in excess of JetBlue’s illusory proposal, which lacks any realistic likelihood of obtaining regulatory approval.”

Wall Street’s Take

Yesterday, Evercore ISI analyst Duane Pfennigwerth decreased the price target on JetBlue to $10 (14.16% upside potential) from $13 and reiterated a Hold rating on the shares.

Overall, the stock has a Hold consensus rating based on five Buys, five Holds, and two Sells. The average JetBlue price forecast of $14.30 implies a 63.24% upside potential from current levels.

Investors Weigh In

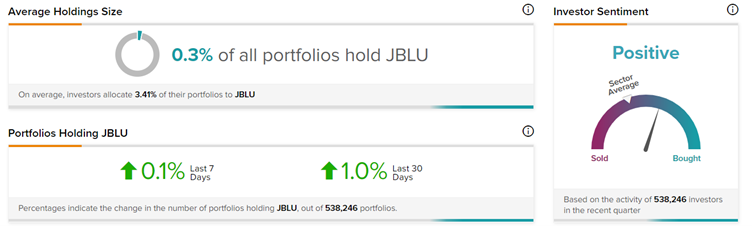

TipRanks’ Stock Investors tool shows that investors currently have a Positive stance on JetBlue, with 1% of investors increasing their exposure to JBLU stock over the past 30 days.

Conclusion

The raging war between JetBlue and Frontier to win over Spirit shareholders continues to intensify ahead of the shareholders’ final vote this Thursday.

Investors will soon know which suitor will win the bidding war to become the low-cost airline giant in the future.