Japanese ecommerce and finance titan Rakuten is said to be eyeing up an IPO of its credit card business in the U.S.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a Reuters report, the Japanese firm began considering the listing of Rakuten Card last month, with the process remaining in its early stages. It is understood that other potential options for the business include a stake sale to a strategic buyer.

Rival Push

One of the main drivers behind the possibility of an IPO, added the article, is rival Japanese group Softbank’s (SFTBY) plans to list app pay operator PayPay in the U.S.

Indeed, earlier this week it was reported that investors expect that the valuation of PayPay could exceed 3 trillion yen or $20 billion when it lists, perhaps as early as December this year.

Rakuten is likely to have a lower valuation in its IPO.

Mizuho Financial Group (MFG) acquired a 15% stake in Rakuten Card for 165 billion yen ($1.1 billion) last year, valuing the business at more than 1 trillion yen, or $7 billion, with the two launching joint credit cards.

Rakuten, which is led by founder and CEO Hiroshi Mikitani, has been pivotal in shaking up Japan’s finance sector by simplifying the process for applying for credit cards and making them available to a wider range of consumers.

Give Japan Credit

Credit cards are an important part of a web of Rakuten businesses spanning online shopping, banking, travel and other services, with customers accruing loyalty reward points by making payments.

Alongside PayPay, it has played a key role in encouraging Japanese consumers to move away from a long-standing preference for cash.

Rakuten Card has issued more than 30 million credit cards in Japan. Non-GAAP operating profit at the business grew 20% to 62 billion yen last year but fell 4.5% in the April-June quarter of this year compared to the same period a year earlier due to higher costs.

Rakuten Card aims to expand profit to 100 billion yen over the medium term and is looking to grow its business with corporate customers, its CEO Koichi Nakamura said in March.

According to Mordor Intelligence Japan’s credit card market size stood at $0.89 trillion in 2025 and is forecast to reach $1.28 trillion by 2030, as the country moves to a more cashless society.

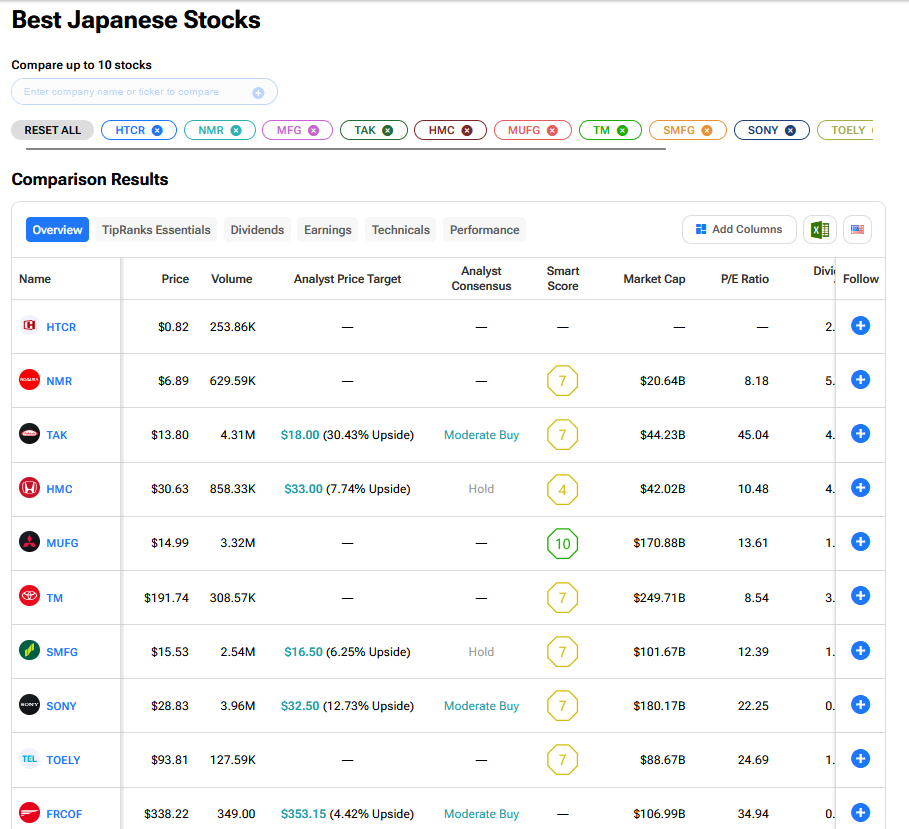

What are the Best Japanese Stocks to Buy Now?

We have rounded up the best Japanese stocks to buy now using our TipRanks comparison tool.