Specialty insurance services provider James River Group Holdings, Ltd. (NASDAQ:JRVR) has been undergoing a multi-year turnaround. Its share price has declined about 61% in the past year, with the company’s latest financial results indicating a decrease in net income. However, reports of a recent proposal for an all-stock acquisition caused a considerable leap in the stock value on Friday. Amid these dynamic changes, it would be wise for investors to tread carefully, as any change in market sentiment can result in abrupt volatility for JRVR stock.

Specialty Insurance

Headquartered in Hamilton, Bermuda, James River Group has been successfully operating since its inception on May 30, 2007.

Over the last three years, the company has worked to reposition around its core strengths while navigating past legacy issues in the commercial auto and casualty reinsurance portfolios. In line with those efforts, the company recently announced the sale of its third-party casualty reinsurance business, JRG Reinsurance Company Ltd. (JRG Re), to Fleming Holdings.

Also, the Board has explored potential strategic alternatives that they promise will be broad-ranging and comprehensive, evaluating options such as a possible sale, merger, or other strategic transaction.

Recent Performance

Shares of JRVR jumped by over 19% on Friday amid reports of an all-stock acquisition offer from Global Indemnity (NYSE:GBLI), as per unnamed sources in Insurance Insider US. The offer is reported to be around $15 per share, implying a total valuation of JRVR at approximately $550 million. It represents a 122% premium to James River’s closing price from the preceding Thursday.

The most recent financial report shows a decrease in net income from continuing operations, dropping from $23.2 million or $0.60 per diluted share in Q4 2022 to $17.4 million, or $0.46 per diluted share in Q4 2023. This marks a significant downturn.

Furthermore, the company reported a substantial net loss of $152.8 million, or $3.43 per diluted share. This was mainly attributable to a considerable net loss from discontinued operations, the most significant contributor being an $80.4 million loss recorded due to the classification of JRG Re as held for sale.

Where the Stock Stands Now

The stock has been on a downward trend. Despite the one-day pop in shares, with a recent price of $7.93, JRVR is trading toward the bottom of its 52-week range of $6.35-$22.15.

Anticipation, rumors, or indications of a potential acquisition can raise stock prices. However, investors should tread carefully during this phase, as these price hikes may be temporary.

If the sale process proceeds, the impact on the stock will depend on numerous factors, such as the deal terms, industry trends, and the fiscal performance of the target company. Acquisitions often result in a stock price increase for the target firm as the acquirer typically pays a premium for the shares to secure shareholder approval (as is rumored to be the case here).

Is JRVR a Good Stock to Buy?

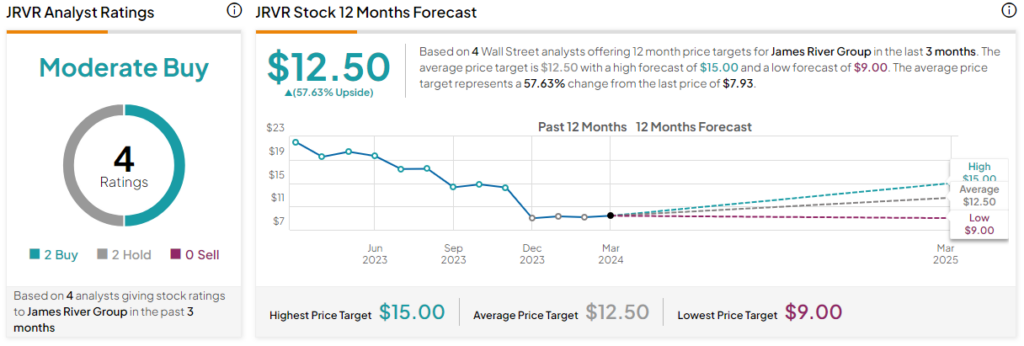

Analysts covering JRVR stock have taken a cautiously optimistic view. So far this year, four analysts have issued two Buy recommendations and two Hold recommendations. Of course, all that may change if acquisition talks prove fruitful.

Based on four analysts’ stock ratings in the past three months, James River Group is listed as a Moderate Buy. The average JRVR stock price target of $12.50 represents an upside potential of 57.63% from current levels.

Final Thoughts

James River Group is in the midst of a strategic repositioning that has it exploring various alternatives, such as a sale. The latest reports indicating a potential acquisition by Global Indemnity are of particular interest if accurate. Despite a recent dip in net income and significant losses from discontinued operations, shares of JRVR could be positioned for a substantial turnaround.

However, as with any significant business development, it’s important for investors to navigate cautiously. While potential acquisitions can trigger a boost in stock prices, such gains may be fleeting if negotiations fall through or market sentiment shifts.