Jabil (NYSE:JBL) shares are trending lower today after the manufacturing services and solutions provider lowered its financial outlook. The company also completed the divestment of its Mobility unit to China’s BYD Electronic (HK:0285) (OTC:BYDIF) in a $2.2 billion deal.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Jabil announced the divestment of its Mobility business in September. The unit produces consumer electronics components. The transaction is expected to enable the company to repurchase more shares and invest in areas such as EVs, renewable energy, and other end-markets. BYD Electronic is a unit of Chinese EV giant BYD (HK:1211) (OTC:BYDDF).

Following the closing of the transaction with BYD, Jabil has updated its outlook. The company now expects to generate an EPS of $1.43 to $1.83 on a revenue range of $6.6 billion to $7.2 billion for the second quarter. Its prior outlook had pegged EPS for the quarter between $1.73 and $2.13 on a revenue range of $7 billion to $7.6 billion.

For Fiscal Year 2024, the company lowered its top-line expectations to $30.6 billion from $31 billion. However, Jabil continues to anticipate $9+ in EPS for the year. Importantly, the company expects to repurchase $2.5 billion worth of shares in 2024.

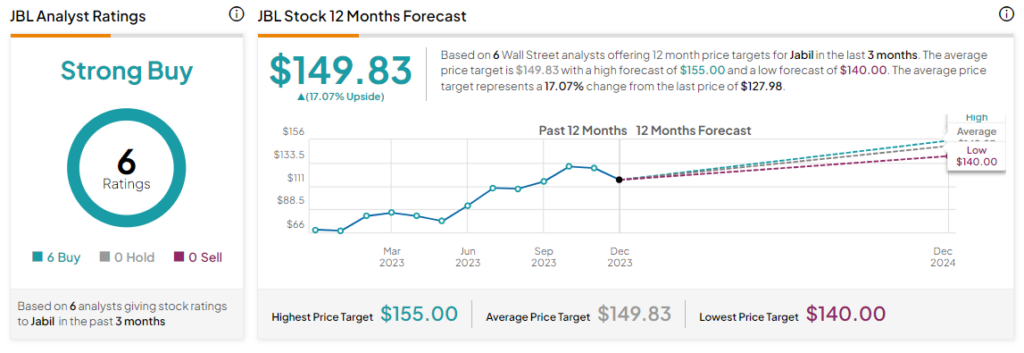

What is the Price Target for JBL?

Overall, the Street has a Strong Buy consensus rating on Jabil. Following a 90% jump in the company’s share price over the past year, the average JBL price target of $149.83 implies a further 17.1% potential upside in the stock.

Read full Disclosure