Last updated: 8:35AM EST

The deal between Hostess Brands (NASDAQ: TWNK) and J.M. Smucker (NYSE: SJM) was confirmed with J.M. Smucker acquiring all of the outstanding shares of Hostess Brands in a cash and stock deal valued at $34.25 per share, representing a transaction value of around $5.6 billion, including the assumption of debt.

According to the terms of the deal, Hostess Brands shareholders will receive $30.00 in cash and 0.03002 shares of SJM (valued at $4.25 as of September 8, 2023) for each share of Hostess Brands common stock. The purchase price indicates a premium of around 54% to the closing price of $22.18 on August 24, 2023.

First published:3:24AM EST

A deal is brewing between food companies J.M. Smucker (NYSE:SJM) and Hostess Brands (NASDAQ:TWNK). The transaction value is expected to be about $4 billion. As per The Wall Street Journal, an official announcement is anticipated later today.

Over the past month, several companies, including General Mills (GIS), Mondelez (MDLZ), PepsiCo (PEP), and Hershey (HSY), have reportedly shown takeover interest in Hostess. This surge in interest followed Hostess Brands’ rising revenues, driven by increased product prices. It is worth mentioning that Smucker faced stiff competition from General Mills in its pursuit of Hostess Brands.

The TWNK deal is in sync with Smucker’s plans to pursue strategic growth initiatives to expand its product offerings in coffee, pet snacks, and other new categories. The impending acquisition of Hostess Brands might support SJM’s performance, considering the rising demand for snacks.

Prior to the expansion moves, SJM shed some of its underperforming businesses. In April, the company divested several pet food brands, such as Rachael Ray Nutrish, Nature’s Recipe, 9Lives, Kibbles ‘n Bits, and Gravy Train brands, as well as its private label pet food business to Post Holdings (POST). The company said that it continues to focus on driving growth for its dog snacks and cat food brands, including Milk-Bone and Meow Mix.

What is the Stock Price Forecast for SJM?

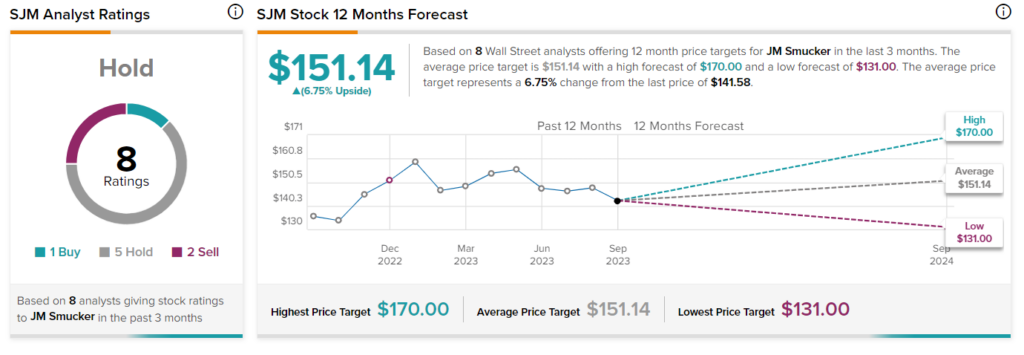

Overall, SJM stock has a Hold consensus rating on TipRanks based on one Buy, five Hold, and two Sell recommendations. The average price target of $151.14 implies a 6.75% upside potential. The stock has declined about 9% so far in 2023.