J.B. Hunt Transport Services (NASDAQ:JBHT) received mixed reactions from analysts following the release of its weak third-quarter results on Tuesday. Since the release, four analysts rated JBHT stock a Buy, four gave it a Hold, and one analyst assigned a Sell rating.

Among the bullish analysts is Top-rated Citigroup analyst Christian Wetherbee. The analyst holds a positive view of the company’s volume and cost trends and future earnings expectations. Further, his outlook for 2025 is built on the expectation that changes in volume will drive pricing and margin improvements, setting the stage for a more normalized bottom line beyond 2024.

Another analyst, Fadi Chamoun from BMO Capital, rated J.B. Hunt stock a Hold and raised the price target to $200 from $190. Despite the weakness in Q3 2023, the analyst is optimistic about the company’s growth, execution, and market position.

It is worth mentioning that JBHT stock declined about 9% in yesterday’s trading session. The company missed both earnings and revenue estimates, as its performance was impacted by subdued shipping demand and lower prices.

What is the Stock Price Prediction for J.B. Hunt?

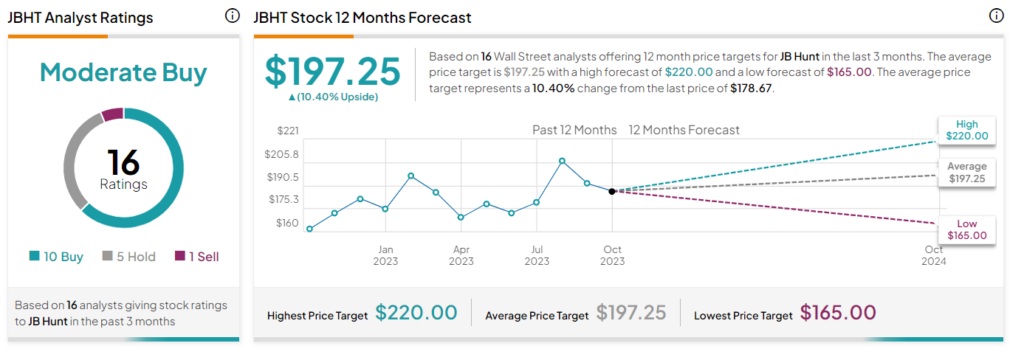

On TipRanks, J.B. Hunt stock has a Moderate Buy consensus rating based on 10 Buys, five Holds, and one Sell. The average stock price target of $197.25 implies a 10.4% upside potential. The stock is up more than 4% so far in 2023.