ITV Plc (GB:ITV) shares gained much-needed momentum after it was reported that the company could dispose of some some of its stake in its production arm, ITV Studios.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The stock gained almost 10% in today’s trading. Overall, the stock has not recovered fully after it fell in March 2022 after the company reported falling viewers and profits.

Since then, ITV has been looking for ways to generate more cash from its assets to push up its share prices. The company also said the board is rigorously trying to find opportunities to generate more value for its shareholders.

ITV Studios is the UK’s biggest production company and is known for shows like Hell’s Kitchen, The Voice UK, and Love Island. Some analysts believe that the production arm might be more valuable than the group company.

Analysts from Citigroup feel selling a stake in ITV Studios would make financial sense. They commented, “If the company could find a way of changing perceptions of the value of the ITV Studios business, this could be meaningfully accretive to valuation.”

Potential companies involved in the discussions are FL Entertainment Group and some other private equity firms.

ITV share price forecast

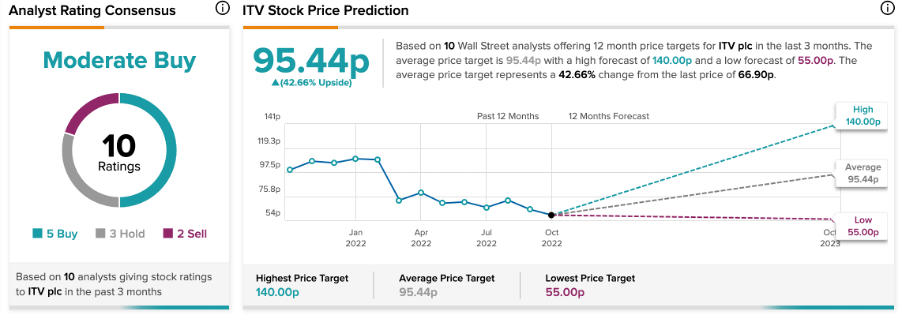

According to TipRanks’ analyst consensus, ITV stock has a Moderate Buy rating.

The ITV price target is 95.4p, which has an upside potential of 42.5% from the current price level. The target price has a high forecast of 140p and a low forecast of 55p.

Conclusion

The company is leaving no stone unturned to bring its share prices back into action. Analysts are positive that this move if materialized, could generate great value for the company and its shareholders.