Uber Technologies (UBER) is set to report its first-quarter earnings on May 7, and investor interest is heating up. Despite persistent macroeconomic headwinds, analysts remain upbeat about the ride-hailing giant’s growth. This optimism is largely due to Uber’s disciplined cost management which has driven strong profitability, and that trend is expected to continue. Meanwhile, the company is also on track to post 15% revenue growth for Q1 2025. With key metrics like bookings, profitability, and mobility trends in focus, the upcoming results could be a critical moment for the stock. Overall, analysts currently rate UBER stock a Strong Buy ahead of the release.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What to Expect from Uber’s Q1 Earnings

Wall Street analysts expect Uber to report an EPS (earnings per share) of $0.51 for Q1, a significant turnaround from the negative EPS of $0.32 in the same quarter last year. Meanwhile, analysts project Q1 revenues at $11.63 billion, according to the TipRanks Analyst Forecasts Page. Based on the company’s guidance, Uber expects adjusted EBITDA to come in between $1.79 billion and $1.89 billion, reflecting year-over-year growth of 30% to 37%.

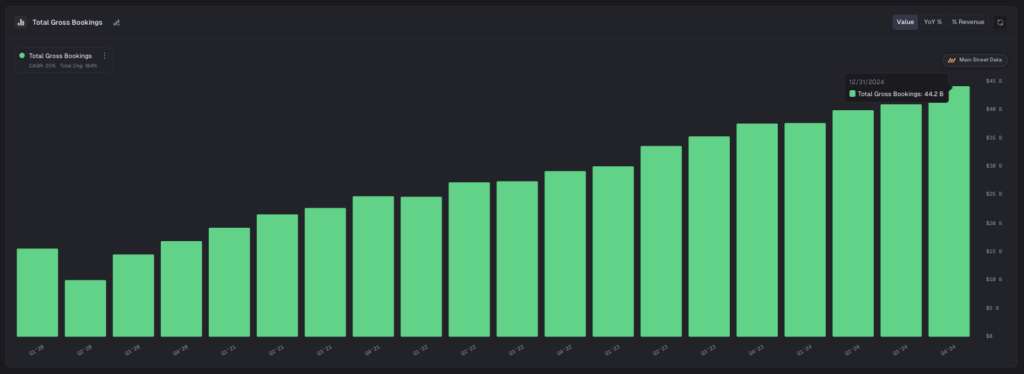

Furthermore, gross bookings are expected to range between $42 billion and $43.5 billion, reflecting a 17–21% increase year-over-year on a constant currency basis. However, the company has flagged the strong U.S. dollar as a potential drag on its results for the quarter. Additionally, factors like high inflation, currency headwinds, and unfavorable weather may dampen gross bookings in Q1.

Despite the anticipated year-over-year growth, gross bookings are expected to decline from the previous quarter’s $44.2 billion. The chart below from Main Street Data illustrates the quarter-over-quarter trend.

On the positive note, any tariff-related impacts won’t likely be reflected in the upcoming Q1 numbers covering January to March. Ultimately, investors will likely focus more on Uber’s forward guidance rather than the headline results.

Is UBER a Good Stock to Buy?

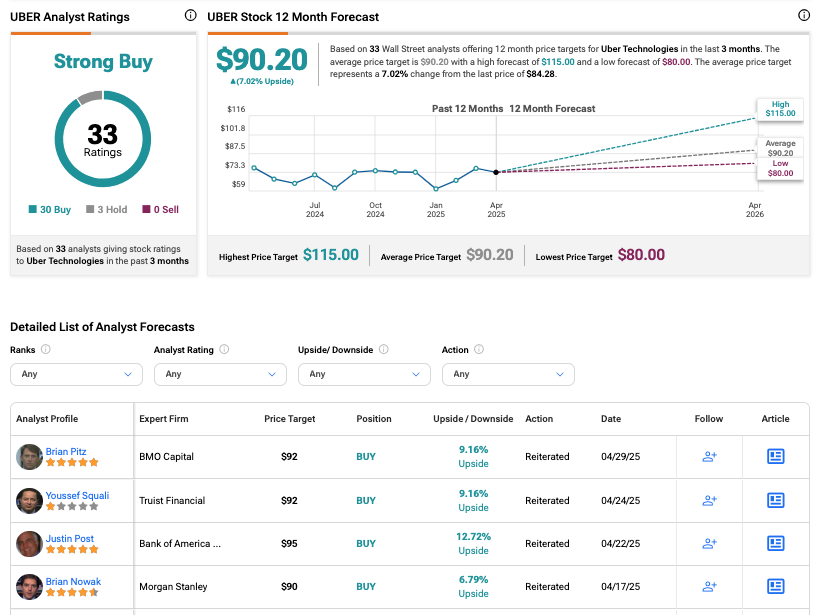

Overall, Wall Street has a Strong Buy consensus rating on UBER stock, based on 30 Buys and three Holds assigned in the last three months. The average Uber price target of $90.20 implies about 7% upside potential from current levels.

Year-to-date, UBER stock has grown by almost 40%.