Advanced Micro Devices (AMD) stock has jumped over 40% in the past three months and nearly 80% this year, fueled by optimism about its growing role in the artificial intelligence (AI) chips market. Its new deal with OpenAI (PC:OPAIQ) shows strong demand for AMD’s chips from leading AI players. Also, Oracle (ORCL) announced that it will use 50,000 AMD chips in its cloud centers starting in 2026, adding to the momentum. With these wins, analysts on Wall Street stay upbeat, and the average price target points to more gains ahead, despite the stock’s big run.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts’ Views on AMD Stock

AMD stock has drawn renewed attention from Wall Street analysts following its new partnership with ChatGPT maker OpenAI. Recently, Top Bank of America Securities analyst Vivek Arya kept a Buy rating on AMD. After hosting an investor call with AMD CFO Jean Hu and VP Matthew Ramsay, Arya said the discussion reinforced his positive view of AMD’s AI roadmap. He highlighted that OpenAI’s first 1-gigawatt AI deployment remains on track for late 2026 and will use AMD’s MI450 Series racks.

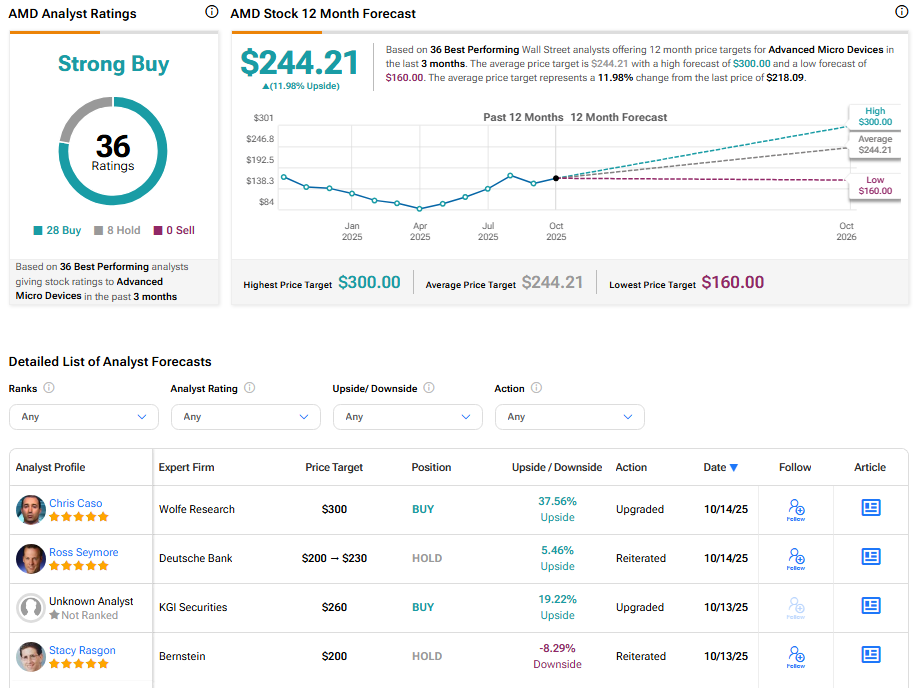

Meanwhile, Wolfe Research analyst Chris Caso upgraded AMD from Hold to Buy and raised his target to a Street-high $300, implying nearly 37% upside. Caso expects AMD to earn $15 billion annually from OpenAI and $27 billion in AI-related sales by 2027. He believes this could lift earnings above $10 per share and push the stock even higher if AI demand continues to rise.

What’s Next for AMD Stock?

AMD is expected to report its third-quarter 2025 results next month. Wall Street analysts expect the company to post revenues of $8.74 billion, up 28% from the year-ago quarter, according to data from the TipRanks Forecast page. Also, earnings are expected to increase by about 27% from the year-ago quarter to $1.17 per share.

During the upcoming Q3 earnings call, investors will watch for updates on AMD’s data center demand and progress in key AI partnerships, which could influence the company’s outlook in the quarters ahead.

Is AMD Stock a Buy, Sell, or Hold?

Currently, Wall Street has a Strong Buy consensus rating on Advanced Micro Devices stock based on 28 Buys and eight Holds. The average AMD stock price target of $244.21 indicates about 11.98% upside potential.