The global aircraft market has been largely synonymous with two names: Boeing (NYSE:BA) and Airbus (OTC:EADSY). However, this duopoly may be under threat as new entrants emerge on the scene and the incumbents face challenges of their own.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Current Challenges for Boeing and Airbus

At present, Boeing is knee-deep in a truckload of challenges, both operational and regulatory. The company is currently facing a double whammy of impacted production schedules and a slow pace of new orders. Moreover, Airbus is facing output delays owing to component and labor shortages. Additionally, its output slots for the A320 offerings are fully sold out until 2030, according to Reuters.

An Opening for a New Market Entrant

Multiple airlines are expected to face delays in the delivery of planes. This dynamic leaves an opening for a new entrant to grab a slice of the overall market pie from Boeing and Airbus.

Recently, the head of Dubai Aerospace Enterprise (DAE), an aircraft leasing entity, noted that China’s state-owned aircraft producer COMAC could make inroads into the jet market over the next decade.

COMAC has, in recent times, bagged multiple orders for its C919 plane. However, these orders have largely come from China’s domestic air carriers. A key challenge for the plane would be to attract overseas interest. The C919 is largely seen as a competitor to Boeing’s 737 MAX and Airbus’s A320. Furthermore, COMAC is already looking to win certification for the C919 in Europe. Last month, COMAC’s top brass paid a visit to Saudi Arabia. Earlier, Saudi officials had visited COMAC’s facilities in Shanghai.

What Is the Target Price for BA Stock?

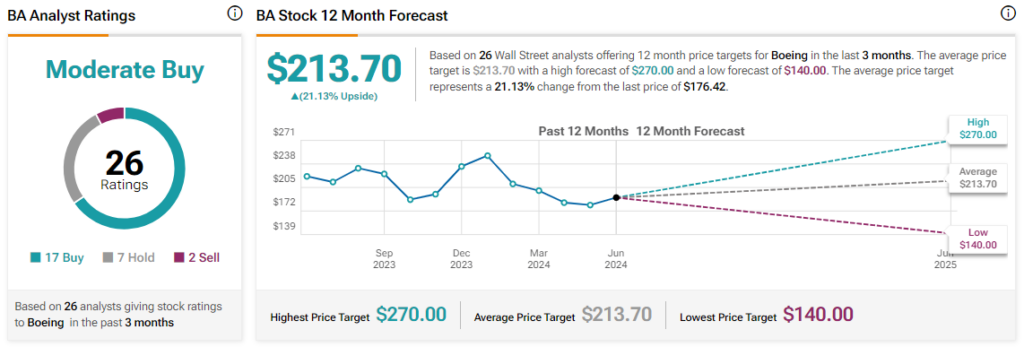

Still, it could be years before COMAC makes meaningful gains in the international market. In the meantime, Boeing’s share price has plunged by nearly 33% year-to-date. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average BA price target of $213.70.

Read full Disclosure