Chinese technology group Tencent Holdings (TCEHY) is set to release its Q1 earnings report on Wednesday. This has some investors wondering whether it’s a good idea to buy shares of TCEHY stock beforehand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Wall Street Expects

Wall Street is expecting Tencent to post first quarter earnings of $0.88, marking an 18.92% year-over-year growth. Revenues for the first quarter are expected to come in at $24.26 billion meaning an 8.89% year-over-year rise.

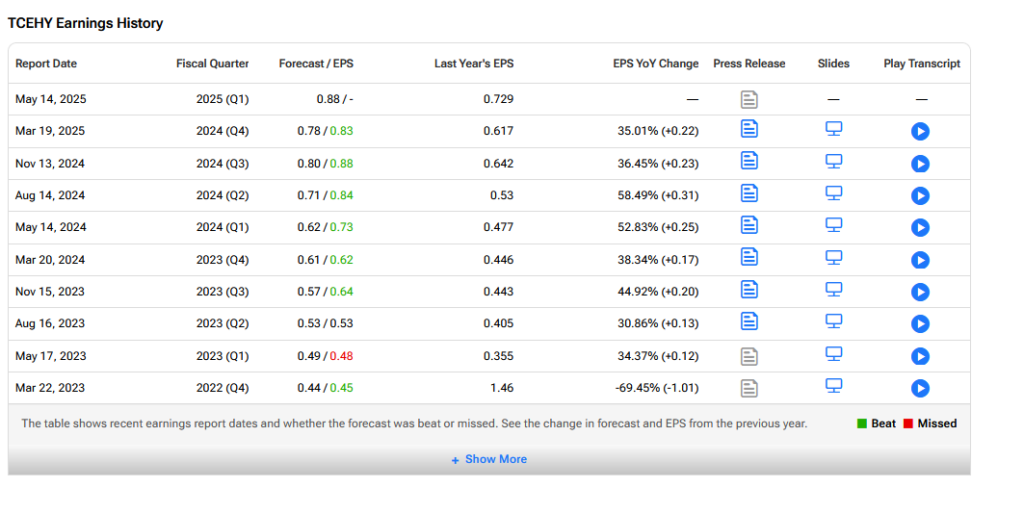

Will Tencent be able to beat these estimates? As one can see below, it has a strong recent record of doing just that.

Key Issues Ahead of Earnings

Analysts will be scouring the Tencent report for its performance across games, advertising, fintech and AI infrastructure. It will also be interesting to note any impact seen to date from President Trump’s tariff strategy when it comes to Chinese imports into the U.S.

In its games division, Tencent is expected to have benefited from recently released games such as Delta Force and DnF Mobile. In advertising it is expected to have seen strong advertiser demand across e-commerce, financials, food, healthcare and education.

In FinTech, commercial payment revenues were flat year over year in the prior quarter, with volume of transactions rising but average selling prices under pressure. The same dynamics are expected to have continued in the first quarter.

The company reported that its AI-native chatbot application Yuanbao saw rapid growth, with Daily Active Users increasing 20-fold from February to March. However, the revenue impact in the first quarter is expected to have been limited due to supply constraints in GPU availability.

Is TCEHY a Good Stock to Buy Now?

Given the lack of analyst coverage of Tencent Holdings let’s take a look at its performance over the last three months. As can be seen it is up nearly 17% over the last 12 weeks.