Investors are preparing for Procter & Gamble’s (NYSE:PG) upcoming dividend increase, aligning with the company’s longstanding tradition of doing so each April for decades. The consumer staples giant, known for its 65 household-name brands across various product categories, boasts a legendary track record. Its upcoming dividend increase will mark the 68th successive annual dividend hike. While this may stimulate interest in the stock among dividend growth investors, I remain neutral on PG due to valuation concerns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Dividend Growth to be Sustained by Robust Results

P&G has sustainably increased its dividend for 67 consecutive years due to its ability to produce robust results under all kinds of economic environments. This time should be no different, with P&G’s household brands generating very stable results during the first half of the company’s Fiscal 2024.

Looking at P&G’s most recent Fiscal Q2-2024 report, the consumer staples giant posted net sales of $21.4 billion, up 3% compared to last year. This figure can, in turn, be broken down into organic growth of 4%, which was offset by a foreign exchange headwind of 1%. Note that the 4% in organic growth was driven by a similar increase in prices, with shipment volumes falling by 1%. The product mix remained stable.

Overall, these findings highlight a familiar reality for the company: it operates within a highly mature industry with constrained growth opportunities. However, this is a highly stable business characterized by predictable consumer purchasing patterns.

The necessities-type nature of P&G’s brands allows for price hikes that tend to match or slightly exceed inflation, thus driving modest revenue growth. Combined with cost efficiencies and buybacks to bolster EPS, P&G has historically been able to afford higher dividends and sufficiently serve conservative dividend growth investors.

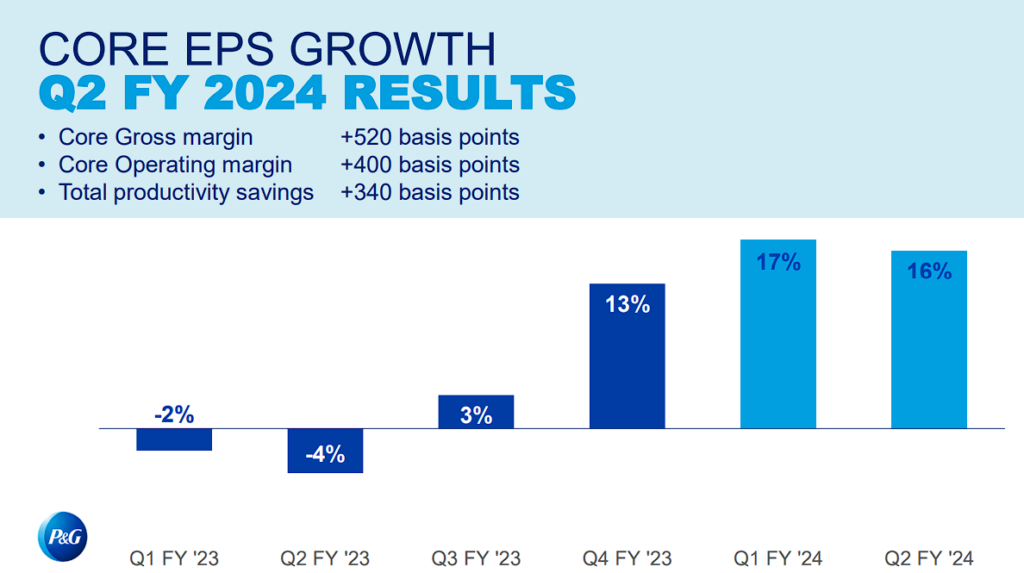

Indeed, P&G managed to lower its cost of goods sold by 7%. It also deleveraged in recent quarters, which resulted in its interest expenses declining by 7%, too, despite most companies being negatively affected by rising interest rates these days. Along with modest share buybacks over the past four quarters, P&G posted Q2-2024 adjusted EPS growth of 16%—a growth rate that notably exceeded the much softer net sales growth.

Is April’s Dividend Hike Going To Be Substantial?

The notable growth in adjusted EPS in Fiscal Q2 suggests that P&G can afford a decent dividend hike next month. This is further backed by management’s expectation of relatively strong earnings growth throughout the year. Specifically, management forecasts adjusted EPS growth between 6% and 9% for Fiscal 2024 from last year’s figure of $5.90 to between $6.37 and $6.43.

I believe that P&G will pursue a dividend increase within this range, which implies an acceleration from last year’s dividend increase of 3%. This is for two reasons:

First, the company can easily afford to do so. The midpoint of management’s guidance ($6.40) implies a forward payout ratio of 59%.

Second, P&G’s recent share gains have pushed the yield down to about 2.3%. This is on the low end of its five-year average of 2.1% to 4.0%. To maintain investor interest and ensure a solid yield in a high-rate environment, it’s essential to implement a dividend increase that meaningfully lifts the dividend yield. In my experience, this tends to be a consideration among boards of directors in such cases.

Valuation Concerns on P&G Stock Persist

Despite P&G posting robust results and gearing up for another dividend increase, investors should stay mindful of the stock’s valuation, which personally concerns me. As mentioned earlier, P&G stock has rallied notably over the past year—specifically, by roughly 14%. Thus, any upside relative to this year’s earnings growth seems already priced in.

In the meantime, the 2.3% dividend yield in a market whose risk-free interest rate hovers above 5% leaves little to be desired. The stock’s forward P/E of 25.3 times the midpoint of management’s outlook for the year also appears rich, again, when taking into account the elevated cost of capital.

On the one hand, investors have historically paid a premium for P&G due to its recession-proof qualities and exceptional dividend growth track record. Thus, I wouldn’t be surprised if this trend persists. On the other hand, there is not really a noteworthy margin of safety against a potential valuation compression at the stock’s current levels. The rather modest dividend could hardly offset any share price losses in such a scenario as well.

Is PG Stock a Buy, According to Analysts?

Checking Wall Street’s sentiment on the stock, Procter & Gamble features a Moderate Buy consensus rating based on 11 Buys and five Holds assigned in the past three months. At $169.60, the average Procter & Gamble stock price target implies 4.8% upside potential.

If you’re unsure which analyst you should follow if you want to trade PG stock, the most profitable analyst covering the stock (on a one-year timeframe) is Dara Mohsenian from Morgan Stanley (NYSE:MS). He boasts an average return of 10.75% per rating and a 91% success rate. Click on the image below to learn more.

The Takeaway

In my view, Procter & Gamble’s upcoming dividend increase, which will mark its 68th successive annual hike, is a testament to the company’s ability to generate robust results over extended periods of time. It’s also a testament to the company’s consistent commitment to rewarding shareholders.

However, valuation concerns persist in a market environment marked by high interest rates. Therefore, I believe that while P&G is likely to keep serving conservative dividend growth investors nicely, investors should weigh the potential risks tied to its current valuation when assessing the stock’s investment case.