Shares of the U.S.-based Oklo Inc. (OKLO) have grabbed attention after dropping nearly 22% over the past five trading days. Looking ahead, analysts remain cautious about the stock’s valuation, noting that upside potential may be limited in the near term. However, Oklo’s long-term growth story, focused on next-generation nuclear microreactors, continues to appeal to investors with a growth-oriented mindset.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Oklo develops compact nuclear microreactors aimed at providing reliable, low-carbon power for commercial and industrial use. OKLO stock declined another 0.94% as of this writing on Wednesday.

What’s Behind the Sharp Decline in OKLO Stock?

The recent drop in Oklo’s stock followed a wave of insider selling over the past few days. Notably, CEO Jacob DeWitte gifted $3 million in shares this week, and director Michael Klein sold $6.7 million. Before this, CFO Craig Bealmear offloaded stock worth $9.4 million. According to TipRanks, the OKLO Insider Trading Activity signal is Very Negative.

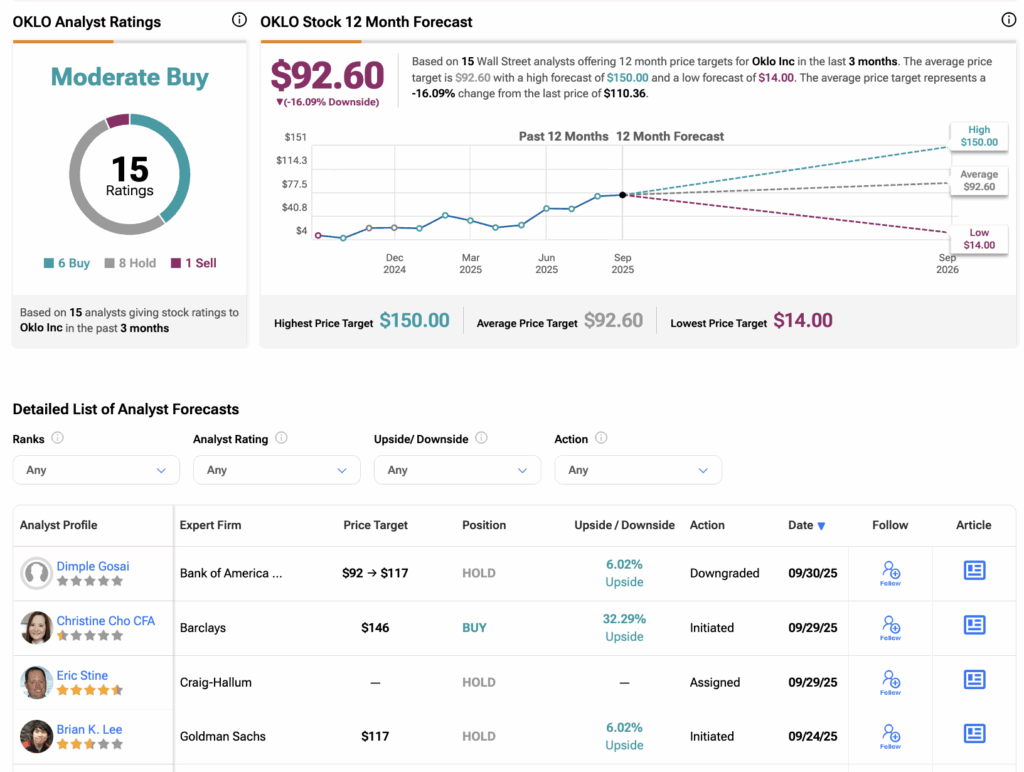

Additionally, investor sentiment was dampened after Goldman initiated a Hold rating on OKLO stock last week. Goldman’s analyst Brian K. Lee has warned investors that Oklo’s valuation appears full and its business strategy needs de-risking. Overall, he projected that shares could fall roughly 11% over the next 12 months to $117 per share.

Likewise, Bank of America’s Dimple Gosai downgraded Oklo from Buy to Hold, citing concerns that the company’s valuation has “run ahead of reality.”

What Lies Ahead for OKLO Stock?

Oklo shares have surged more than 420% this year as investors bet on nuclear power for AI data centers. However, the company hasn’t yet obtained the regulatory license for its first 75-megawatt nuclear microreactor, Aurora Powerhouse. Moreover, the company won’t start commercial operations until late 2027 or early 2028.

Looking ahead, OKLO faces a mixed outlook. The company’s long-term potential in next-generation nuclear microreactors is appealing, but it still lacks key regulatory approvals. Analysts warn that its valuation is stretched and the capital-intensive business model carries significant risks.

In the short term, the stock may remain volatile, but growth-focused investors could find long-term upside if OKLO successfully de-risks its operations and secures contracts.

Is OKLO a Good Stock to Buy?

Overall, Wall Street has a Moderate Buy consensus rating on OKLO stock, based on six Buys, eight Holds, and one Sell assigned in the last three months. The average share price target for Oklo is $92.60, which implies a downside of 16.09% from current levels.