The banking industry continues to face challenging conditions with factors such as historic increases in interest rates and a prolonged inverted yield curve exerting pressure. Berkshire Hills Bancorp (NYSE:BHLB) has successfully navigated this macro environment, and the stock has been up over 20% over the past six months. So, is now the time to invest in Berkshire Hills Bancorp?

The bank’s rigorous expense management and proactive asset quality management have led to several recent changes, including the sale of branches. Investors might be wise to take a wait-and-see approach to the stock to ensure these changes translate to positive results before initiating a position.

Berkshire Hills Bancorp Up Close

Berkshire Hills Bancorp is a Boston-based bank holding company that operates as the parent firm for Berkshire Bank and Berkshire Insurance Group. It boasts $12.1 billion in assets and operates a network of 96 financial centers across New England and New York State. The company’s diverse portfolio includes commercial, retail, wealth, and private banking solutions.

The firm recently announced the sale of ten branches, aiming to boost operational efficiency and profitability and concentrate on primary markets in New York. The finalization of the branch sale is expected in the third quarter.

Newsweek magazine has recognized Berkshire Bank as one of the top 10 most trusted banks in America. This accolade highlights Berkshire’s dedication to principles of integrity and respect and its commitment to maintaining transparency in its relationships with clients.

BHLB’s Recent Financial Results

The bank recently reported first-quarter financial results, recording a loss of $20.2 million or -$0.47 per share. This was countered by operating earnings of $20.9 million or $0.49 per share, surpassing the consensus of $0.47. Despite a non-operating charge of $49.9 million, primarily due to selling $362 million worth of securities, after-tax deductions led to a decrease of $38.3 million or $0.89 per share.

The company finished the quarter with a strong balance sheet, ending with a common equity Tier 1 ratio of 11.6% and a tangible common equity ratio of 8.2%. The bank repurchased 182,000 shares in the first quarter for $4.3 million, and its Board of Directors approved a quarterly cash dividend of $0.18 per common share to shareholders.

Is BHLB Stock a Buy, Hold, or Sell?

The stock has been range-bound for some time, and trades in the middle of its 52-week price range of $18.07-$25.79. It is demonstrating positive price momentum trading above the 20-day (21.47) and 50-day (21.87) moving averages.

The stock appears to be relatively fairly valued, with a P/BV ratio of 0.95x, which is in line with the regional bank industry average of 0.84x.

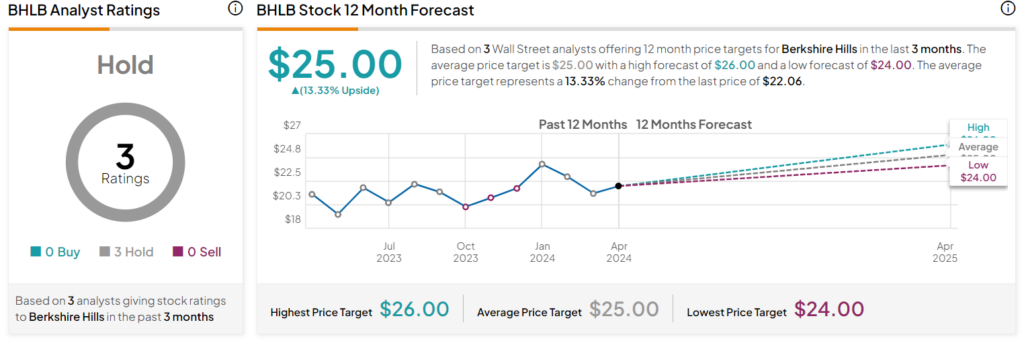

Berkshire Hills Bancorp is rated a Hold based on the recommendations and 12-month price targets three Wall Street analysts assigned in the past three months. The average price target for BHLB stock is $25.00, which represents a 13.33% upside from current levels.

Bottom Line on BHLB

Berkshire Hills Bancorp has shown resilience and positioned itself for potential growth by maneuvering through a challenging macro environment and implementing strategic changes, such as selling branches, to bolster efficiency and profitability. The bank’s financial performance has also been noteworthy, most recently reporting first-quarter financial results that surpassed expectations. Translating these strategic and financial maneuvers into positive results is yet to be fully realized. Prudent investors should consider taking a measured approach, monitoring the results of these changes before initiating a position.