Chinese automaker Nio (NIO) is set to report its first-quarter 2025 results on June 3, before the U.S. market opens. The stock has struggled this year, falling about 16% year-to-date and underperforming the broader market as well as peers like XPeng (XPEV), Li Auto (LI), and BYD (BYDDY)(BYDDF). Although Nio has improved its deliveries and margins, economic worries, weak consumer demand in China, and intense competition in the EV market have hurt its performance. As a result, analysts remain cautious on the stock ahead of the earnings release.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What to Expect from Nio’s Q1 Earnings

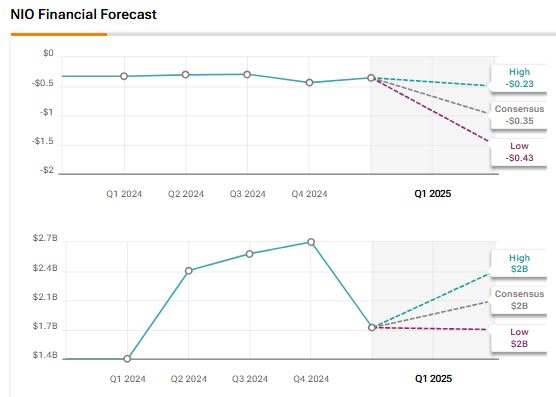

Wall Street analysts expect Nio to report a loss per share of $0.35 for Q1 versus a loss of 0.33 in the same quarter a year ago. According to the TipRanks Analyst Forecasts Page, Nio’s sales forecast for Q1 is $1.74 billion, with estimates ranging between $1.71 billion and $1.79 billion.

In the previous quarter (Q4 2024), Nio delivered a disappointing earnings report, missing Wall Street’s expectations on both revenue and profit. The company posted a loss of $0.43 per share, compared to the expected loss of $0.30. Also, revenue came in at $2.7 billion, falling short of the $2.81 billion estimate. That said, both metrics still reflected year-over-year improvement.

As Nio prepares to release its Q1 2025 results, investors will be paying close attention to updates on new model launches and the company’s ongoing efforts to reduce costs.

Morgan Stanley Analyst Remains Bullish Ahead of Earnings

Despite the concerns around Nio’s recent performance, Morgan Stanley analyst Tim Hsiao has maintained a Buy rating on the stock. He also kept his price target at $5.90 per share, suggesting a potential upside of 60.3% from current levels.

According to Hsiao, Nio’s recent launch of updated versions of the ET5 and ET5 Touring could help the company improve its competitive position in China’s crowded EV market. He also believes that sales will continue to grow steadily over time. Looking ahead, he expects Nio to reach breakeven by 2028.

Is Nio a Buy, Sell, or Hold?

Overall, Wall Street has a Hold consensus rating on NIO stock, based two Buys, seven Holds, and one Sell assigned in the last three months. The average NIO stock price target of $5.07 implies 37.77% upside potential from current levels.