Chinese automaker Nio (NIO) is scheduled to announce its results for the first quarter of 2025 next week on June 3 before the opening of the U.S. markets. Wall Street expects Nio’s Q1 loss per share to come in at $0.35 on revenues of $1.74 billion. Ahead of the Q1 earnings, Morgan Stanley analyst Tim Hsiao maintained a Buy rating on the stock with a price target of $5.9 per share, citing strategic product upgrades and improved competitiveness. The price target of $5.9 implies an impressive 30.9% upside potential from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Product Refresh May Reignite Growth

Hsiao’s bullish stance is driven in part by Nio’s recent launch of the facelifted ET5 and ET5 Touring models, which retain their 2024 price tag of RMB298,000 but feature over 500 configuration upgrades and 45% of parts redesigned. Key enhancements include Nio’s in-house NX9031 5nm smart driving chip, a larger AMOLED display, heads-up display (W-HUD) as standard, longer battery range, and chassis improvements.

The analyst believes that the updated ET5 models, along with the refreshed ES6 and EC6 SUVs launched on May 16, should strengthen Nio’s position in China’s electric vehicle market, particularly in the crowded RMB300k price segment. These models go up against strong contenders like Xiaomi’s SU7 and YU7, ZEEKR 001, AVATR 11 and 12, and Denza Z9.

However, Hsiao believes that while these new vehicles offer “remarkable performance,” Nio’s success will depend on “equally remarkable corporate execution” to restore delivery momentum. He also highlighted that sufficient launch stock for these models could help mitigate any near-term supply bottlenecks.

Going forward, the analyst believes Nio could see strong sales growth over time and expects the company to reach breakeven by 2028.

Is Nio a Buy, Sell, or Hold?

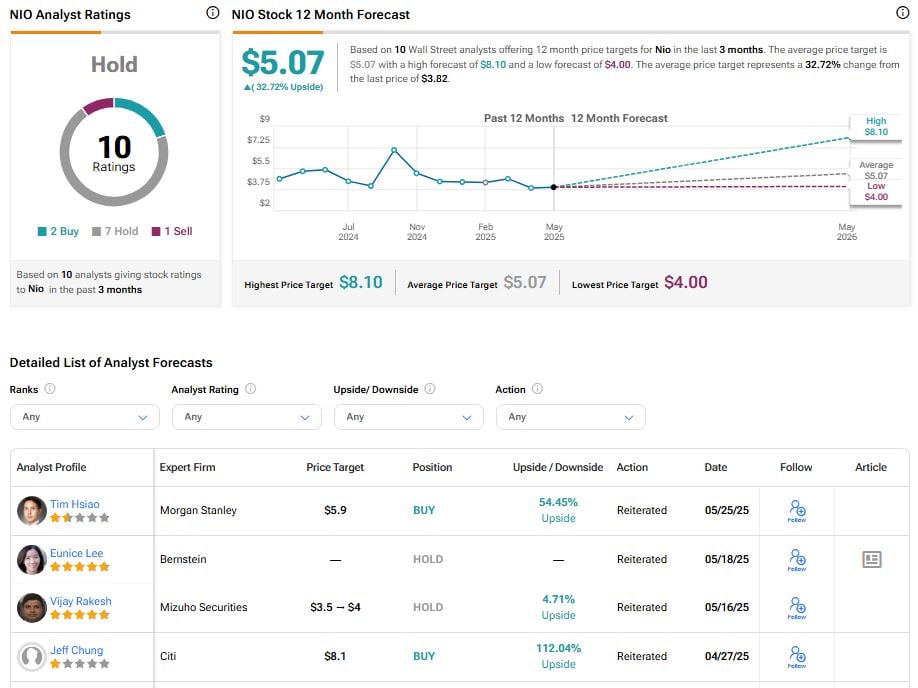

Nio has a Hold consensus rating on TipRanks, backed by two Buys, seven Holds, and one Sell. The average NIO stock price target of $5.07 implies 32.72% upside potential from current levels. Nio stock have plunged about 13% year-to-date due to worries over intense competition in the domestic market and tariff concerns.