Meme stock Beyond Meat (BYND) announced this morning that it is delaying the release of its third-quarter results to November 11, from the originally scheduled date of November 4. The plant-based meat producer said it needs additional time to determine the amount of an impairment charge for certain assets. Shares are trending down nearly 4% following the announcement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Street expects Beyond Meat to report a sales decline amid softening consumer demand, a weakening supply chain in the U.S., and higher prices compared to conventional meat.

Recently, Beyond Meat’s stock surged briefly, jumping from roughly $0.52 in mid-October to over $7 in under a week, before retreating to around $2. This spike was mainly driven by Beyond Meat expanding its Walmart (WMT) partnership to 2,000 U.S. stores. However, most of this rally appeared to be fueled more by renewed hype from meme traders than by solid improvements in its business fundamentals.

Expectations from Beyond Meat

The Street expects Beyond Meat to report a nearly 16% year-over-year drop in sales to $68.98 million. Meanwhile, the consensus for a diluted loss of $0.40 per share is mostly in line with the prior year’s loss of $0.41 per share.

The company unexpectedly released its preliminary results for the quarter ending September 27, 2025. Beyond Meat projected Q3 revenue of $70 million, slightly exceeding analyst expectations and within its previously guided range of $68 million to $73 million. However, the figure represents a decline from $81 million recorded in the same period last year, indicating ongoing weakness in demand.

Additionally, the company said it expects gross margins of 10% to 11%, or 12% to 13% on an adjusted basis, including $1.7 million in costs related to China exit. It will also take an undisclosed non-cash impairment charge on long-lived assets. Operating expenses are projected at $41 million to $43 million, including $2 million in one-time legal and restructuring costs.

Although Beyond Meat’s slight Q3 revenue beat is encouraging, investors will be looking for more insight into its China exit, asset impairments, and growth outlook during the November 4 earnings call.

What Analysts Are Saying About Beyond Meat

Wall Street remains bearish following Beyond Meat’s preliminary results update. Mizuho Securities analyst John Baumgartner reiterated his “Sell” rating while lowering the price target from $2 to $1.50, implying 9.4% downside potential. The analyst cited the company’s weak fundamentals, significant equity dilution following a debt restructuring, and ongoing financial instability, including declining revenues and increased losses.

Additionally, Barclays analyst Benjamin Theurer kept his “Sell” rating and $2 price target, implying 20.9% upside potential from current levels, citing similar headwinds.

Overall, analysts have a Moderate Sell consensus rating on BYND, based on zero Buys, two Holds and five Sell ratings on TipRanks. The average Beyond Meat price target of $2.08 implies 25.7% upside potential from current levels.

Is Beyond Meat a Good Stock to Buy?

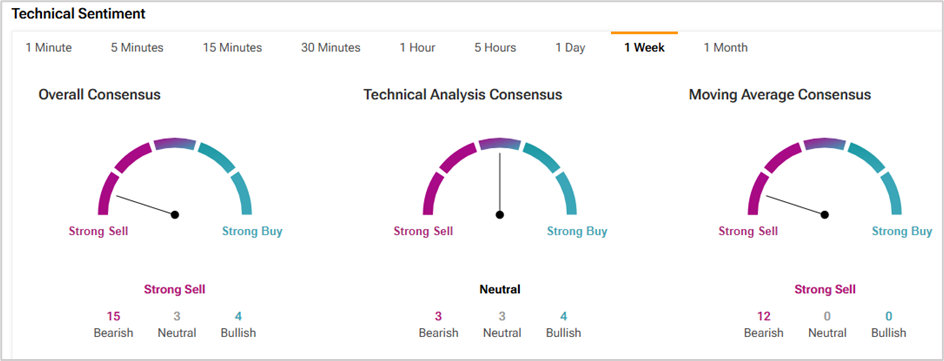

We used TipRanks’ Technical Analysis Tool to assess the outlook for BYND stock. The tool indicates a “Strong Sell” consensus, with 15 indicators showing Bearish signals, three Neutral, and four Bullish.