Carnage ensued in the crypto markets, yanking the price of Bitcoin (BTC-USD) to its 18-month low of around $22,000.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Consequently, many crypto stocks took a beating, with shares of cryptocurrency exchange platform Coinbase Global (NASDAQ: COIN) dropping 11.4% on June 13 to its lowest ever level at $52.01. The stock was further down another 5% during the pre-market trading session today following the news of 18% job cuts.

In fact, Coinbase shares have plunged almost 85% below their IPO price of $381 in April 2021, losing most of their valuation in the past six months.

18% Job Cuts

With the aim of better managing its operating expenses amid the cryptocurrency market collapse, Coinbase announced a cut in the company’s workforce by approximately 1,100 employees. This represents approximately 18% of the company’s full-time global workforce as of June 10, 2022.

Upon the completion of the workforce reduction, the company will have a total number of employees of 5,000 as of June 30, 2022.

The company is expected to incur approximately $40 million to $45 million in total restructuring expenses in connection with the aforementioned restructuring plans.

Though the company did not make any changes to its FY2022 outlook provided in May, the company now expects its technology and development, and general and administrative expenses to come in near the lower end of the previously given range.

Tumbling Crypto market

Not just Bitcoin, but other popular digital currencies like Ethereum (ETH-USD) are seeing lower lows in the recent past.

On June 13, crypto lender Celsius ordered a redemption freeze on all withdrawals, swaps, and transfers between accounts, citing extreme market conditions.

Following its footsteps, Binance also temporarily stopped bitcoin withdrawals for several hours, citing a stuck transaction causing a backlog.

Grimly, since the start of the weekend, over $200 billion has been drained out of the cryptocurrency market.

Wall Street’s Take

Following the crypto crash on Monday, JPMorgan analyst Kenneth Worthington downgraded Coinbase Global from Buy to Hold and also slashed the price target to less than half at $68 (30.7% upside potential) from $171.

Kenneth Worthington continues to believe that Coinbase is the leading driver and beneficiary of the cryptocurrency economy with strong organic and inorganic growth opportunities.

However, based on the recent weakness in the cryptocurrency markets, the analyst believes Coinbase’s revenue and share price performance will remain under pressure in the near term.

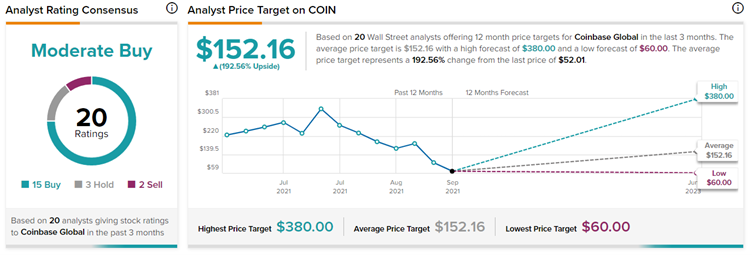

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 15 Buys, three Holds, and two Sells. The average Coinbase Global stock forecast of $152.16 implies 192.56% upside potential to current levels.

Conclusion

Overall, investors’ sentiments have been extremely pessimistic due to the never-ending macroeconomic headwinds, increasing inflation, and higher interest rates.

Amid growing uncertainties, investors choose to exit risky investments to safeguard their money. As a result, Bitcoin, Ethereum, and other major alternative currencies have floundered in the last few weeks.

If the situation doesn’t stabilize in the cryptocurrency markets, then COIN stock could slide down further, especially with declining crypto volumes as reported by the company in the previous quarter.