Technology company Hewlett Packard Enterprise (HPE) is set to report its Q2 earnings results on June 3 after the market closes. Analysts are expecting earnings per share to come in at $0.33 on revenue of $7.45 billion. This compares to last year’s figures of $0.42 and $7.18 billion, respectively.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Although it is nice to see revenue grow in the double digits, it is not ideal when earnings decline. Nevertheless, the firm’s income tends to be cyclical, as demonstrated by the image below, and it’s worth noting that HPE has beaten earnings estimates nine times during the past 10 quarters. Therefore, it is possible that EPS can come in above last year’s figure. Investors will also be closely watching for any commentary from HPE’s management regarding the potential impact of tariffs and trade policies on the company’s supply chain and profitability.

Interestingly, according to a report by Connor Hart of The Wall Street Journal, HPE is getting ready to increase prices on some of its products and speed up plans to shift more of its manufacturing out of China. At the same time, HP has lowered its financial forecast for the year. CEO Enrique Lores explained that the impact from tariffs was larger than expected and affected more countries than they had planned for. Because of this, the company is adjusting its strategy to handle the extra costs and reduce its reliance on Chinese manufacturing.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a 9.8% move in either direction.

Is HPE Stock a Buy?

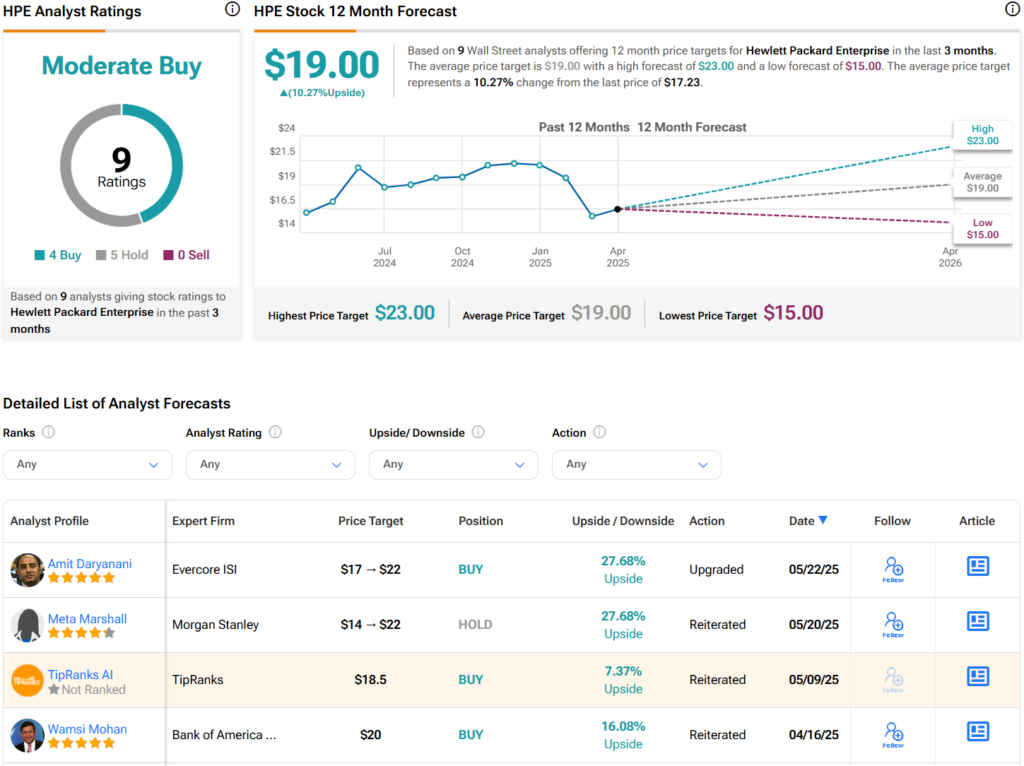

Turning to Wall Street, analysts have a Moderate Buy consensus rating on HPE stock based on four Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average HPE price target of $19 per share implies 10.3% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue