Costco (NASDAQ:COST) is a membership-only retailer that sells everything from gasoline to groceries to merchandise. I’m bearish on COST stock because I believe its valuation is exorbitant and suggests unusually high growth rates decades into the future. At 47x earnings, Costco’s valuation is in bubble territory and ignores the inherent risks of retailing.

Costco’s Valuation Ignores the Risks

Over the past few years, the mantra has been to pay up for quality businesses. Costco is certainly viewed as a quality business. However, Sears and Kmart were also quality businesses at one time, and they have since filed for bankruptcy. Retailing is a difficult, low-margin industry, which is all the more reason to invest with a margin of safety.

To explain the risks of investing in retailers, let’s go down memory lane and have a look at Kmart’s history. In the Nifty Fifty bubble of 1972, Kmart stock had a P/E ratio of 54x. The stock collapsed shortly thereafter alongside other overvalued Nifty Fifty stocks. Fast forward to 2005, and Kmart merged with dominant retailer Sears (known for its Sears catalogue). But as e-commerce emerged, Kmart and Sears filed for Chapter 11 bankruptcy in 2018.

Now, that’s not to say that Costco will go bankrupt anytime soon (it has a relatively strong balance sheet and competitive position), but I do believe investors are getting a little too confident about Costco’s future, similar to what happened with Kmart in the Nifty Fifty bubble of 1972.

If we combine Costco’s TTM (trailing 12 months) common dividends paid with its share repurchases, we get $3.2 billion returned to shareholders over the past year. If we divide this by Costco’s $319 billion market cap, we get just a 1% shareholder yield. Costco’s total earnings yield isn’t much better at 2.1% Both these numbers pale in comparison to the effectively risk-free 5% yield you can get on short-term government bonds and in money markets. For this reason, I believe COST is in bubble territory.

The Case for Slowing Growth and Capped Margins

Over the past 12 years, Costco grew its store count at just 3.2% per annum, but its revenue grew faster at 8.7% per annum, as the U.S. economy boomed on the back of low taxes and government spending. This, combined with some margin expansion and buybacks, allowed Costco to grow its EPS at 12.9% per annum since 2011.

I don’t see this growth continuing, though. Costco’s net margin is now at an all-time high, and its buybacks are ineffective at 47x earnings. Costco’s growth will likely be capped by the fact that it has to reinvest a substantial portion of its cash flow into new stores. Also, with the U.S. more indebted than ever before, the government may have to raise corporate taxes and cut government spending, both of which could put an end to margin expansion at Costco.

Costco is heavily dependent on the U.S. economy, with 600 of 871 locations in the “United States and Puerto Rico” and another 148 locations in neighboring countries:

The fact that Costco sells an awful lot of gasoline and cafeteria food at what appears to be breakeven or worse prices doesn’t help its margin expansion case. If Costco were to put an end to either of these subsidized items, it could lose its members.

Costco’s net margin is already greater than that of Kroger (NYSE:KR) and Walmart (NYSE:WMT). Still, my experience shopping at Costco often leaves me feeling like I’ve paid too much, with expensive, bulky brand-name items. Further, the company has already pulled many of its margin expansion levers, such as cutting credit card transaction fees by signing exclusive deals.

I think Costco is likely to grow EPS at around 9% per annum in the decade ahead. With a P/E ratio of 47x, this would give Costco a PEG (price-to-earnings-to-growth) ratio of 5.2x. For reference, only a PEG ratio of less than 1.0x is generally considered undervalued. As exuberance fades and risks are priced in, Costco’s P/E multiple could get cut in half or worse. The historical median P/E ratio for an S&P 500 (SPX) company is just 15x.

Costco’s Change in Leadership

Ron Vachris recently became CEO of Costco, replacing Craig Jelinek, who had a long and glorious tenure from 2012-2023. This, combined with the death of famous shareholder and Costco board member Charlie Munger, as well as the retirement of long-time CFO Richard Galanti, adds uncertainty to the Costco story. Costco was incredibly well-run under Jelinek, and Charlie Munger added wisdom, rationality, and a long-term mindset to Costco’s board that simply cannot be replaced.

Luckily, Jelinek and Galanti will remain, albeit in a lesser role, on the board of directors. Still, I believe the simultaneous loss of these three great leaders is the equivalent of Berkshire Hathaway (NYSE:BRK.B) losing Warren Buffett. We’ll have to wait and see what Ron Vachris can do and if Costco can keep its culture and long-term mindset in the decades ahead. The company’s valuation certainly depends on it.

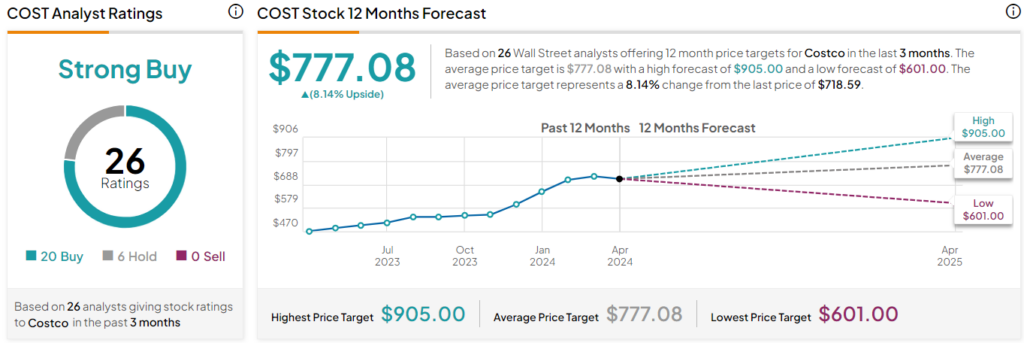

Is COST Stock a Buy, According to Analysts?

Currently, 20 out of 26 analysts covering COST give it a Buy rating, six rate it a Hold, and zero analysts rate it a Sell, resulting in a Strong Buy consensus rating. The average COST stock price target is $777.08, implying upside potential of 8.1%. Analyst price targets range from a low of $601 per share to a high of $905 per share.

The Bottom Line on COST Stock

Costco is a remarkable business, but the problem is everyone already knows it. As famous investor Stanley Druckenmiller once said, “What’s obvious is obviously wrong, and it’s already reflected in security prices. If everything is rosy, it’s already in the stock price and already in the market. There’s nobody left to buy.”

COST stock looks like it’s in bubble territory at 47x earnings. I think the U.S. tailwind Costco enjoyed over the past decade could grind to a halt as the government scrambles to deal with its budget deficit and record debt-to-GDP ratio. The case for margin expansion at Costco looks weak, with many levers having already been pulled. Also, the simultaneous loss of board member Charlie Munger, CEO Craig Jelinek, and CFO Richard Galanti could sting.