Cryptocurrency exchange Coinbase (COIN) is set to report its Q3 earnings results on October 30 after the market closes. Analysts are expecting earnings per share to come in at $1.15 on revenue of $1.8 billion. This compares to last year’s figures of $0.28 and $1.21 billion, respectively. Interestingly, Coinbase has a mixed track record when it comes to beating earnings. In fact, it has only done so in nine of its last 16 quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, investors will be keeping an eye on the company’s Subscription and Services revenue, along with its Transaction revenue, which is Coinbase’s largest and most volatile segment, as pictured below. However, Stablecoin revenue will also be in focus, as it is quickly becoming a major growth driver.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting an 8.5% move in either direction.

Is COIN a Good Buy Now?

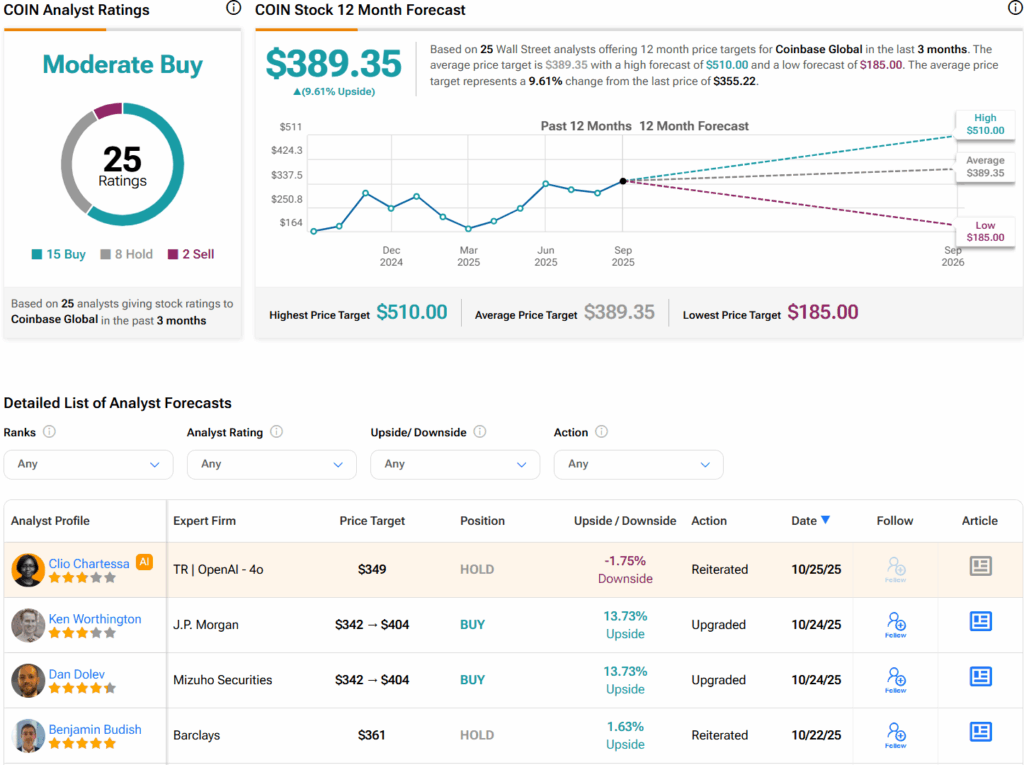

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Coinbase stock based on 15 Buys, eight Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average COIN price target of $389.35 per share implies 9.6% upside potential.