IREN Limited (IREN), the data center infrastructure company, saw its shares accelerate by more than 5% during early trading on Wednesday, extending an 8% gain from the previous day’s regular session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This comes as the company, which is seen as a rising competitor to Nvidia (NVDA)-backed CoreWeave (CRWV) and Microsoft partner (MSFT) Nebius, raised $1 billion from a zero coupon senior convertible note offering. IREN intends to expend portions of its net proceeds of about $979 million from the debt instrument on its working capital and general business activities.

IREN Debt Offering Attracts Investors

The company noted that the new offering received strong patronage from investors and was oversubscribed. The notes are expected to expire in 2031, even as IREN plans to set aside $56.7 million to buy back shares before the notes are converted to equity upon expiry.

The new funding round is the latest effort by IREN to boost its financial base, even as the company recently reversed its quarterly losses with a net income of $176.9 million.

Earlier this month, the company, which was previously largely focused on mining Bitcoin, also raised $875M in convertible senior notes.

IREN Sees Strong Demand for AI Cloud Business

IREN has continued to shift it focus to meeting the demand for cloud computing workloads by Big Tech companies. This is even as Daniel Roberts, IREN’s co-founder and co-CEO, recently noted that the demand for the company’s AI cloud service is accelerating.

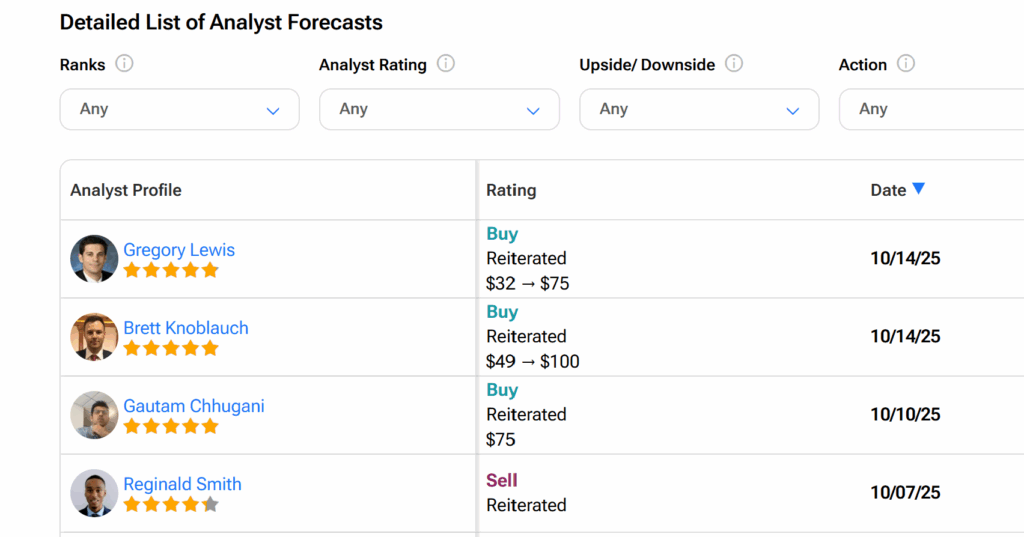

Since the start of the year, IREN’s shares have skyrocketed by more than 608%, reaching more than $74 per share on Wednesday morning. However, five-star analysts from Cantor Fitzgerald and BTIG believe that the stock has room for more growth, and yesterday raised their price targets for IREN stock by more than 100%.

IREN builds and operates AI data centers completely powered by renewable energy. It recently secured a major multi-year contract to deploy thousands of Nvidia’s Blackwell graphics processing units.

Is IREN a Good Stock to Buy?

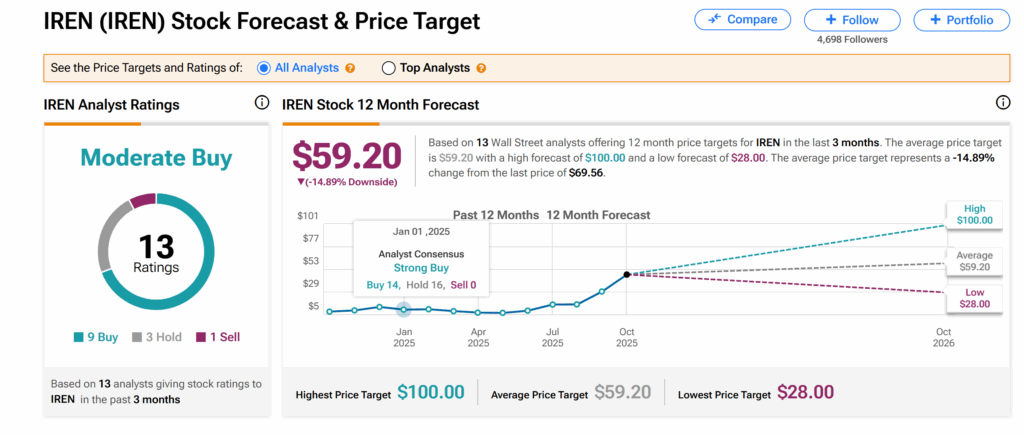

Across Wall Street, analysts generally hold a more reserved outlook on IREN Limited’s shares. IREN stock currently has a Moderate Buy consensus rating, as seen on TipRanks.

This is based on nine Buys, three Holds, and one Sell rating assigned by 13 Wall Street analysts over the past three months. Moreover, the average IREN price target of $59.20 indicates a 15% downside risk from the current level.